With Trump back in the news, fossil fuels are back too. Post taking office, the executive orders signed by Trump include concrete measures taken in this regard, meaning a real shift in the oil and gas markets. Thus, a probable kicker is shaping up for fossil fuels to exist and thrive despite the green wave. And, natural gas is the best of both these worlds, being a fossil but with lower carbon emission, effectively a green fossil.

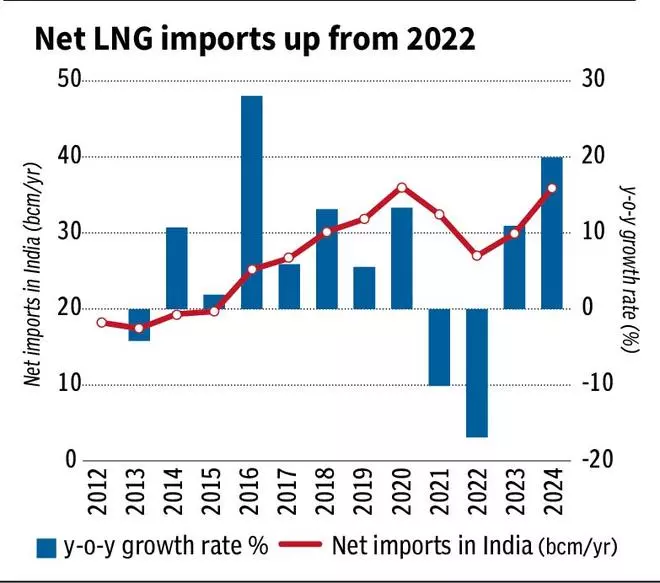

India is the fourth-largest importer of natural gas globally. The Government of India (GoI) has set an ambitious target to increase the contribution of natural gas to the country’s energy mix to 15 per cent by 2030 from around 6.45 per cent in 2023.

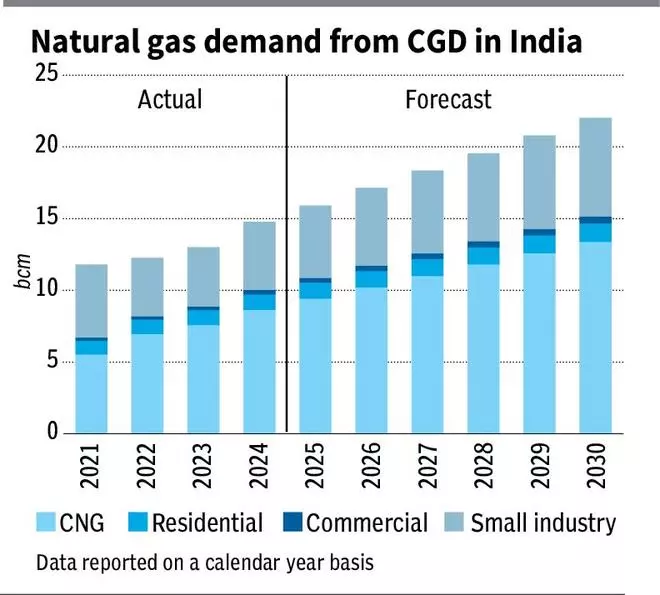

Natural gas consumption has doubled to 65 billion cubic metres (bcm) in 2023 from 2000-levels. And though the target set by the GoI would require consumption levels to triple from here, by 2030, International Energy Agency (IEA) in its outlook on India’s gas market (dated February 2025), expects the sector to grow, a more probable 60 per cent from here by the same timeline, hitting 103 bcm.

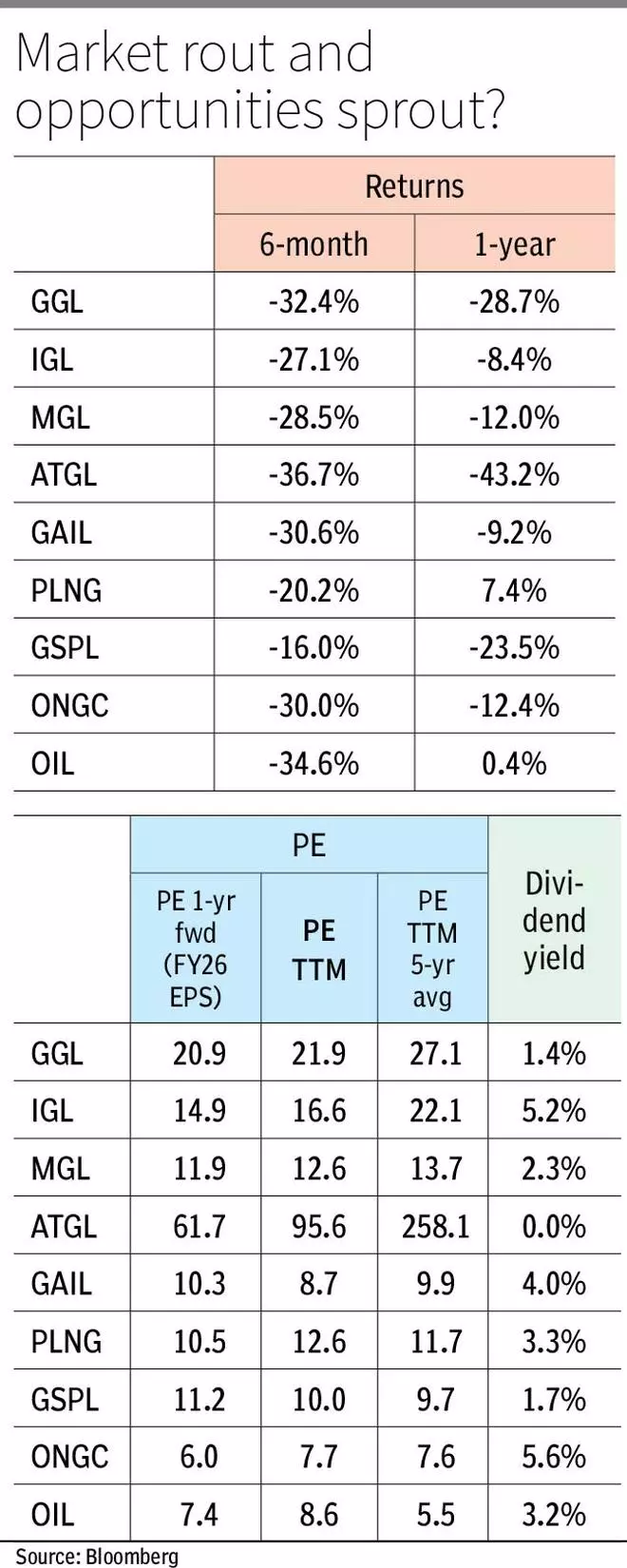

In this context, with Nifty Oil and Gas having corrected 30 per cent from its peak in August 2024 and trading at a 13-month low, how can investors play this space now and are there any attractive dividend-yield counters or value-buys? We have this covered in this article. But before that, it is important to get a grip on the industry dynamics.

The What

Natural gas is formed beneath the surface due to years and years of decomposition of organic matter under geological conditions, akin to crude oil. Primarily consisting of methane, it is extracted by drilling into rock formations where they are trapped.

It is very common to confuse the same with LPG (liquefied petroleum gas), which is a by-product of crude oil refining and natural gas processing and made up of propane and butane.

Both the fuels have combustible features and compete against each other with common end-users. However, natural gas is a relatively cleaner fuel with carbon emissions on combustion being lower, which goes hand in hand with its net zero emission target.

So, how is natural gas expected to pull up its sleeve and fight for an increased contribution in the energy mix?

Pull factors

One, sustained capex in building out gas transmission infrastructure is expected to help with increased penetration and the subsequent conversion of existing users of alternate liquid fuels to natural gas, both from domestic household and industrial markets.

The total length of operational natural gas pipelines stood at around 23,500 km as of mid-2024, which is expected to be expanded to 35,200 km by 2030. And, while there are seven operational natural gas terminals currently, three new terminals are under construction while three more are in planning stages.

The government is also mulling the possibility of strategic underground gas reserves. With strategic reserves for crude oil in place, considering the volatility in gas prices in 2022, feasibility studies are underway by ONGC, Oil India and GAIL for a capacity of up to 4 bcm (equivalent to around 20 days of demand considering 2024 consumption). Such reserves will help relatively insulate the country from supply concerns, acting as a buffer for absorbing price volatilities.

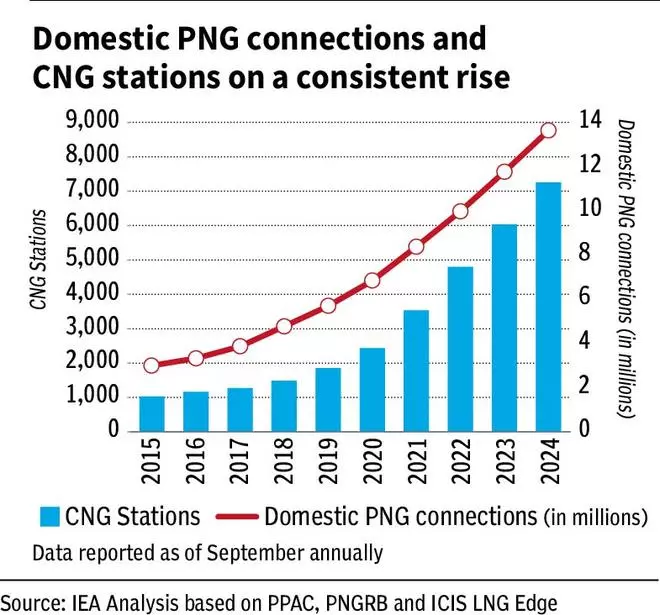

Two, the increasing adoption of compressed natural gas (CNG) vehicles in the three-wheeler and four-wheeler space. While the share of CNG-fuelled vehicles are just at around 2 per cent as a percentage of total vehicles on road, during FY22-24, the CNG segment grew at 16.3 per cent CAGR while petrol and diesel vehicles grew at a slower 6.7 per cent and 5.2 per cent respectively. With delta between prices of CNG and petrol/ diesel still wide in most regions, price economics continue to favour CNG vehicles. CNG-fuelled hybrid vehicles are also finding good offtake.

Though EVs have grown at a CAGR of 87 per cent (thanks to the low base) during the same period owing to a developing EV infrastructure, CNG still remains the preferred fuel for heavy vehicles.

Three, the proposal to bring natural gas under the purview of GST, if implemented, will help simplify the tax structure. Close competitors of natural gas — coal and LPG — are already under the GST regime, while currently, the State governments impose VAT at different rates across different States, ranging from around 3 per cent to 25 per cent, apart from excise duty, customs and central sales tax, in the case of natural gas. Thus, bringing natural gas within the ambit of GST could potentially help reduce the net cost, consequently promoting wider adoption and enhancing its competitiveness against other fuels.

So, how is natural gas priced domestically and how volatility affects its competitiveness?

Pricing mechanism

The pricing of natural gas is strongly linked with what kind of oil and gas field, natural gas is extracted from. Broadly, there are three types – old legacy fields, new oil fields and high-pressure high-tension (HPHT) fields.

HPHT fields are those which are relatively much complicated and deep-seated deposits, bringing serious complications to drilling and the consequent production.

Old legacy fields, largely operated by ONGC and Oil India, are earmarked and price regulated under the administered price mechanism (APM). The output from these fields is allocated primarily to priority sectors.

Currently, City Gas Distribution (CGD) (to meet the demand for domestic piped natural gas (PNG) and CNG), fertiliser manufacturing and power generation are amongst the top priority sectors, whose demand is met with subsidised APM prices.

However, allocation to these sectors is based on the supply and availability, and might not always be equivalent to the demand. For example, while the allocation to CGDs was more than or equivalent to the demand for PNG and CNG until FY22, the increase in demand along with the recent cuts in APM allocation to CGDs has widened the gap (between allocation and demand) to a range of around 30-40 per cent now.

The remaining demand for natural gas in India is largely met through domestic production from new oil fields, HPHT fields and imports where prices are largely linked to the prevalent market forces.

From around 85 per cent of the domestic gas supply coming under APM in 2020, the same number is at 64 per cent for 2024. While new oil fields coming online and volumes supposedly falling from the legacy oil fields (yet to be officially confirmed) are the reasons, both have led to increased prices. This could be corroborated with the recent price hikes by CGDs post the cut in allocation of APM gas since October 2024.

India being a very price-sensitive market, any upward spike in prices of natural gas results in customers shifting to alternate fuels. Taking an example, the Morbi industrial region in Gujarat, which drives around 60-70 per cent of natural gas volume for Gujarat Gas (GGL), has seen demand drop around 35 per cent now from 2022 levels, thanks to the sustained premium of natural gas against LPG, for most parts since 2022.

So, how are different players in the natural gas ecosystem placed?

City gas distribution

Thanks to the cut in APM gas allocation by around 30 per cent (though it was partially reinstated in December 2024), Indraprastha Gas (IGL), Mahanagar Gas (MGL), GGL and Adani Total Gas (ATGL), the listed CGD players, have all seen their profits drop in Q3 FY25. Their EBITDA per standard cubic metre (scm) seen during 9M FY25 is lower than the average of the last three years.

But except for industrial volumes, which have been volatile, demand from domestic, commercial and CNG segments have been on the rise and average volume numbers recorded in 9M FY25 have been the highest in the last four years.

IGL and MGL have shown good volume growth at a CAGR of 9 per cent and 11 per cent respectively during FY22 to now. GGL, however, had been pulled down by its dependence on industrial volumes (around 60-70 per cent of sales) and is yet to reach its FY22 levels.

ATGL, on the other hand, has around 70 per cent of its sales coming in from CNG, hence better placed.

Pipelines and transmission

Natural gas volumes both on the supply side and transmission side continued to rise for GAIL. State-owned, GAIL operates natural gas pipelines and is involved in the exploration and production, import, transmission, marketing and distribution in India. It derives around 85-90 per cent of its revenue from supply and transmission of natural gas. Other revenue streams include production and sales of downstream products such as petrochemicals, hydrocarbons and LPG.

9M FY25 average gas transmission volume stood at 129.45 mmscmd in line with the guidance of 129-130 mmscmd for the year and up from FY24’s 120 mmscmd. Average volumes sold/ traded also increased from 98 mmscmd in FY24 to 99.8 mmscmd in the 9M FY25.

The management has guided for around 7 per cent volume growth in the next two fiscal years. GAIL has also requested for a revised transmission tariff from the current ₹58.9 per million BTU (British thermal units) to ₹78 per million BTU, which will help with better realisations and will remain a key monitorable.

Gujarat State Petronet (GSPL), GGL group’s gas transmission player, saw volume growth continue to come in from the CGD segment while other segments continued to remain flat. Also, a key monitorable is the transmission tariff that was cut by the regulatory authority by around 47 per cent effective May 2024, which has hit profit margins in the current FY. However, the same has been challenged by the company in the Delhi High Court.

Import and regasification

Petronet LNG (PLNG), another State-owned entity, is in the business of setting up and operating LNG import and regasification terminals. Breaking it down, the company imports natural gas (based on confirmed demand) in liquid form, converts it back into gas form and feeds it into the gas grid for GAIL, IOCL and BPCL — its prominent customers. PLNG operates two terminals, in Dahej and Kochi, and accounts for around 34 per cent of gas supplies and 74 per cent of LNG imports in India.

Dahej is the only terminal in India operating at near 100 per cent capacity utilisation from FY24, thanks to the proximity to key demand centres and well-developed pipeline infrastructure connecting it with key supply grids. Other terminals in India (owned by Indian Oil Corporation, Shell, ATGL, GSPC etc.), including PLNG’s Kochi terminal, are running at less than 60 per cent utilisation. PLNG is also undertaking a brownfield expansion to expand its Dahej facility by around 28.5 per cent from current levels, which will help meet future growth in demand.

Throughput (essentially, volumes) handled in 9M FY25 has been highest ever for PLNG at 729 trillion BTU (British thermal units) against 685 trillion BTU year on year.

Exploration and Production

ONGC and Oil India, State-owned companies, are involved in the exploration and production (E&P) of crude oil and natural gas.

The Indradhanush gas pipeline, being developed in the North-East, is expected to aid Oil India increase its penetration and offtake, where limited pipeline infrastructure has historically dented its ability to sell more.

The ramp-up in ONGC’s relatively-new oil field in the Krishna-Godavari Basin is also expected to aid ONGC in volume growth in both gas and oil.

However, natural gas only contributes around 20 per cent to their revenue, at best currently, for these companies.

Returns, valuation and dividend-yield

All the above companies have given negative returns in the last six months.

All the CGD players are also trading at a discount to their five-year average TTM PE. While ATGL is trading at an expensive 95.6 times its trailing 12-month EPS, IGL and MGL are trading at a reasonable 16.6 times and 12.6 times respectively. GGL, on the other hand, though marred by the volatility in industrial volumes, is trading at a slightly elevated 21.9 times. Bringing in the dividend yield factor into play, IGL looks the most attractive of the lot with a dividend yield of 5.2 per cent alongside reasonable valuations.

Since, our last call to book profits in GGL, the stock has corrected around 36 per cent. It could be tracked from here for good entry points.

GAIL is trading at a TTM PE of 8.7 times, which is lower than its five-year average TTM PE of 9.9 times. While the dividend yield is at 4 per cent at current levels, the pick-up in gas volumes sold and revision in tariffs will be key monitorables.

PLNG, on the other hand, is trading at a discount to its five-year average TTM PE. And while the growth in domestic production of LNG is expected to be flat or grow moderately, imports are expected to pick up the slack. Thus, with the planned capacity addition coming online in June 2025 and dividend yield at 3.3 per cent, PLNG looks fairly placed as a good proxy-play to the natural gas industry with strategically-placed terminals and long-term contracts to source LNG.

GSPL, however, is trading at a slight premium to its five-year average TTM PE with a dividend yield of 1.7 per cent.

For ONGC and Oil India, essentially commodity plays, growth largely hinges on increase in production or increase in realisation. Dividend-yield for ONGC looks attractive at 5.6 per cent, while it is relatively lower at 3.2 per cent for Oil India.

Overall, the sector has structural tailwinds shaping up. But, investors should note and understand the cyclical nature of this industry. Hence, while considering investments in this space, one must closely track the sustainable dividend-yield and valuation before jumping on board. In times of market volatility, this sector could be a defensive play.