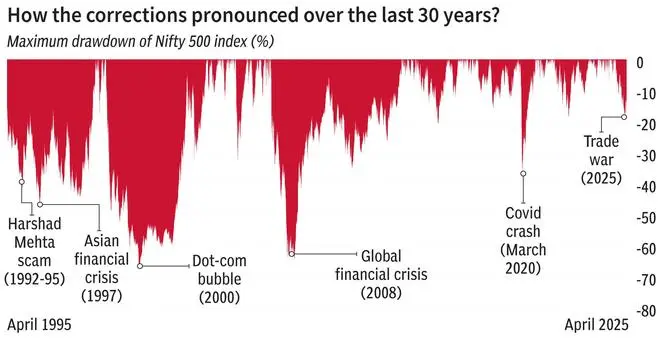

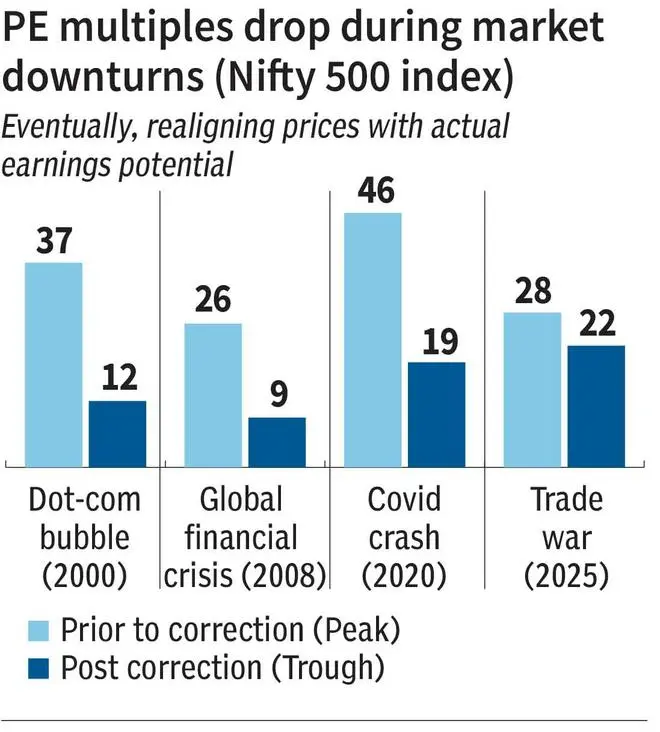

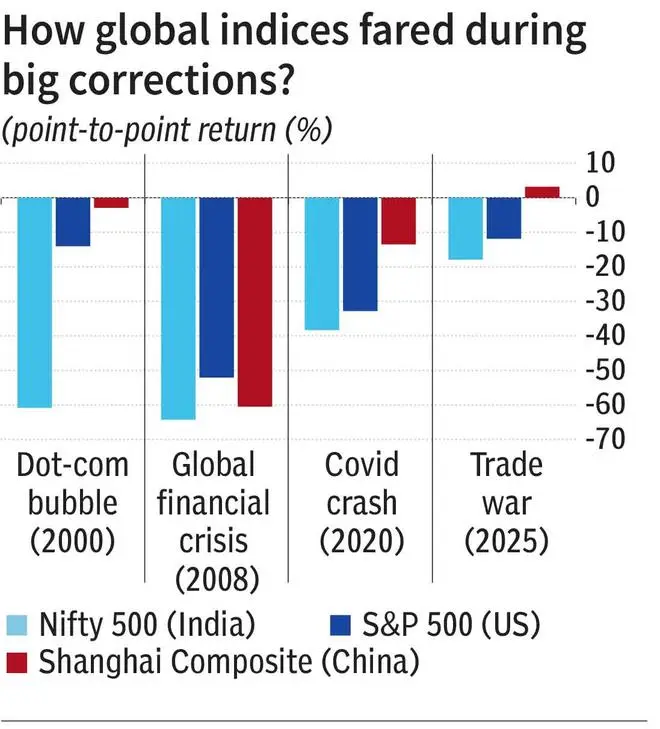

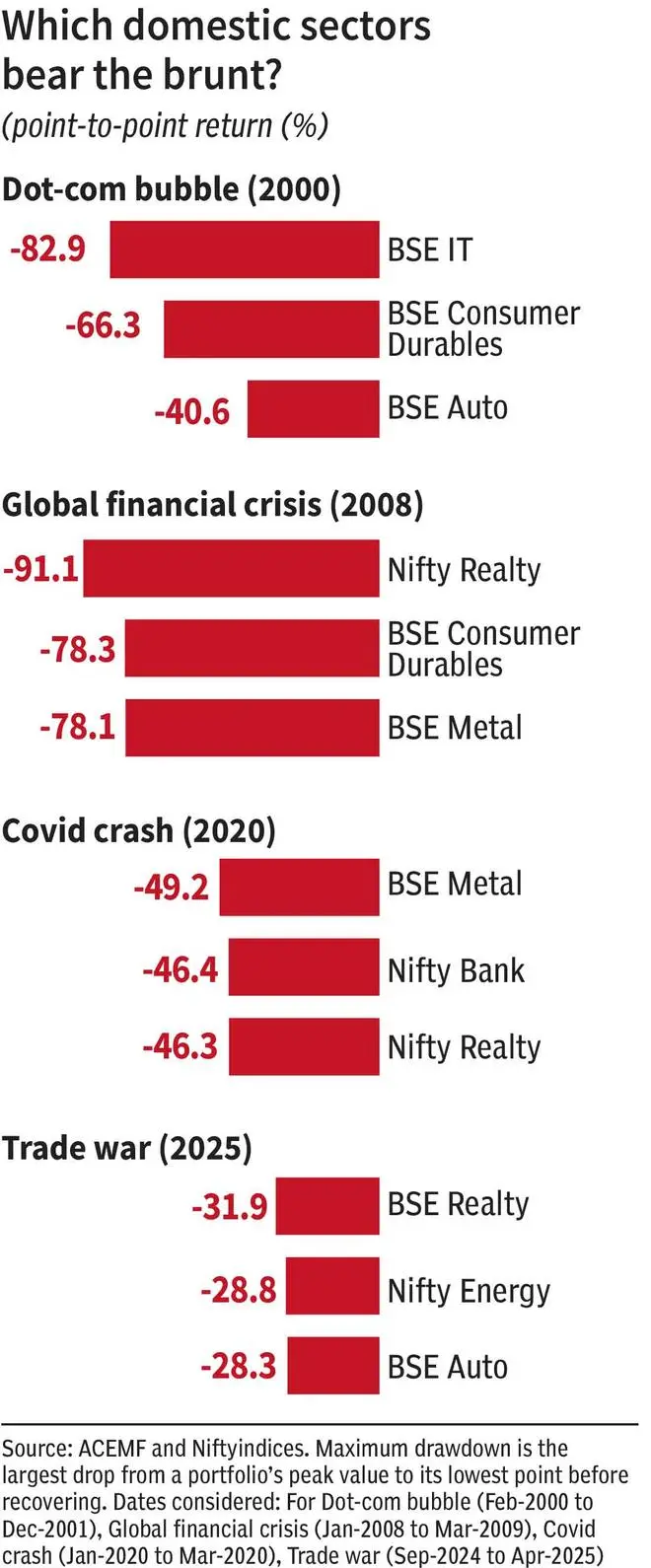

Indian equity markets corrected significantly since September 2024, triggered by heightened geopolitical tensions, escalating global trade war fears, large-scale FII outflows, and domestic growth concerns. Historically, market corrections occurred due to macroeconomic shocks, policy shifts, and changing investor sentiment. These natural resets are often amplified by panic selling, margin calls, and liquidity crunches, eventually realigning prices with actual earnings potential. A look at how past corrections compare in scale to the present one.

Published on April 8, 2025