The latest news out of the US is that it could be heading into a recession. In Fox News’ programme, “Sunday Morning Futures with Maria Bartiromo”, when US President Donald Trump was asked if he expected a recession this year, his answer was, “I hate to predict things like that. There is a period of transition because what we’re doing is very big.”

Trump’s policies are certainly big, and they are highly disruptive. Measures including increases in import tariffs, cutting down expenditure, laying off government employees, moving out of critical trade agreements and generally going on a rampage to burn bridges built over several decades, are sure to have dire consequences including recession, not just in the US, but in other countries too.

Surprisingly, most stock market participants were euphoric in November when Trump won the Presidential elections, prophesying that his term will improve the prospects for the US and its companies. The US equities, bonds and currency markets rallied strongly in the months after the results. But the Oracle of Omaha, appears to have been quite unimpressed by Trump’s win. Not only has Warren Buffett been selling his profitable positions, but his cash holding has also increased to record levels in 2024.

The obvious reason for the increase in cash levels of Berkshire Hathaway was the overheated US market with valuations becoming extremely pricey. This made bargain buys hard to come by. But Buffett also appears to have anticipated the turmoil that was likely to ensue once Trump began fulfilling his campaign promises.

Very high cash position

Answering criticisms about this elevated cash position, Buffett wrote in his annual letter, “Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities — mostly American equities… Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses.”

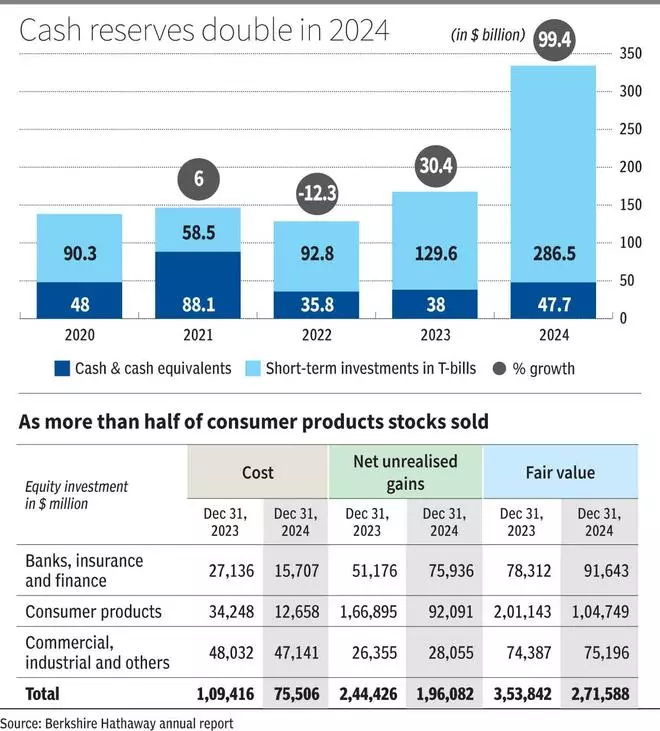

But despite these assurances, cash and cash equivalents and short-term investments in Berkshire Hathaway’s consolidated account stood at $333.3 billion in December 2024. This is almost double the cash reserves in December 2023, which was $167.5 billion.

This is reported to be the highest ever and constituted 28 per cent of the company’s consolidated balance sheet. Cash reserves also surpassed the value of the company’s portfolio of partially owned stocks of $271.5 billion in 2024.

The cash is however being put to good use with $286.4 billion invested in US treasury bills in 2024; an increase of 121 per cent in the last one year. This is a good move given the rising yields on US treasury securities. Interest income of the insurance business increased by over $4 billion in 2024.

The reason why Buffett is increasing the cash pile is not difficult to seek. He is simply not able to find good investment opportunity in the overvalued US market. According to factset, the forward 12-month price earning multiple for the S&P 500 is 20.7 currently. This is at a premium to the 5-year average (19.8) and above the 10-year average (18.3). Some stocks in consumer discretionary and technology sectors have been sporting sky high valuations.

His quandary is captured in the annual letter, “We are impartial in our choice of equity vehicles, investing in either variety based upon where we can best deploy your (and my family’s) savings. Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities.”

The year 2024 was probably one which was almost devoid of opportunities. But Buffett could also have been cautious about making large investments ahead of the impending turmoil.

More sales than purchases

It is for this reason that the purchases by Berkshire Hathaway were not substantial last year. The company purchased the remaining stake in Pilot, a fuel marketing company, residual stake held by non-controlling shareholders of Berkshire Hathaway Energy Company and some shares of VeriSign and Sirius XM Holdings. But there were hardly any large purchases.

If we look at the investment activity of Buffet in 2024, he has purchased equities worth $9.2 billion, down from $16.4 billion in 2023 and $67.9 billion in 2022. On the other hand, his purchases in treasury bills and fixed maturity securities have been going up from $183 billion in 2022 to $235 billion in 2023 to $526 billion in 2024.

Equity investments in consumer products, in fair value term, has halved from $201 billion to $105 billion. While some of Buffett’s favourite stocks such as Coca Cola and American Express did not experience a large rally in prices or valuation, stocks such as Apple have seen a large run up in price.

According to Motley Fool, Berkshire had 50 per cent of its 41-stock portfolio invested in Apple as of December 2023. But Buffett sold 605 million shares through the first three quarters of last year, such that Berkshire had just 26 per cent of its portfolio invested in Apple as of September 2024. With trailing 12-month PE ratio in Apple increasing from 26.5 in March 2024 to 39.7 by December 2024, it is not surprising that the value investor became uncomfortable about holding this stock.

Finally

It is common for investors to scour Berkshire’s annual report and annual letter to shareholders for investment lessons. But this time, the writing on the wall is bold and clear. Don’t get swayed by the crowd and go strictly by valuation while making investment decisions.

He is also indicating that staying on the fence is the best strategy when uncertainty is high. As he said in the annual letter 2025, “Paper money can see its value evaporate if fiscal folly prevails. In some countries, this reckless practice has become habitual, and, in our country’s short history, the US has come close to the edge…”

Investing in sound companies, but at the right price, is therefore the way forward. Until then, cash it is.