The anticipated shift in tariff policy in the US under the new administration is increasing uncertainties around the world. With this shift, the US is aiming to address trade imbalances with its major partners and boost domestic manufacturing. India, a net exporter to the US, will be directly impacted by this policy change. World Bank data shows that the total merchandise trade between India and the US grew at a compound annual growth rate of 5 per cent between 2014 and 2022. In 2022, the US accounted for 11 per cent of India’s total trade, whereas India accounted for only 2.5 per cent of US’s total trade.

The average tariff rates India charged on US’s agriculture, mining, and manufacturing products were 32 per cent, 10 per cent and 30 per cent respectively, whereas US charged around 3.2 per cent, 0.5 per cent and 5 per cent, respectively on India. Given India’s higher import tariffs, the US may respond by raising tariffs on the Indian exports, mirroring a trade dispute between these countries in 2018 and 2019. Therefore, the question arises whether it would be advantageous for India to impose reciprocal tariffs in response to increased US tariffs or to offer tariff concessions as presumptive measures to avoid higher US tariffs?

Rapid assessment

Using an economy-wide model for India, we have conducted a rapid assessment to derive some indicative insights of the bilateral tariff policies between India and the US on the Indian economy. This model is based on the wide database consistent with the National Accounting System of the Ministry of Statistics and Programme Implementation. We have solved this model for five years between 2022-23 and 2026-27 corresponding to three counterfactual scenarios.

Scenario 1: US imposes additional tariffs and India does not reciprocate. Scenario 2: India reciprocates to the US tariffs increase. Scenario 3: As a pre-emptive action, India offers tariff concessions to avoid US tariffs increase.

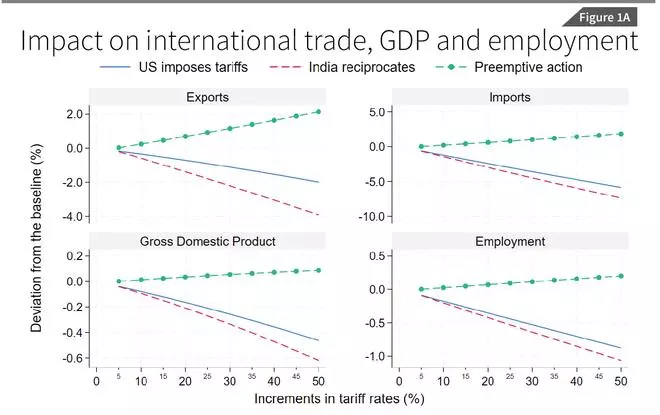

Considering the uncertainties around the tariff rates, we have assumed an incremental range in tariffs from 5 to 50 per cent for the analysis. The increase in US tariffs will make Indian products costlier in the US market, as a result demand for Indian products will decline in the US and the Indian exporters will incur losses in revenue. In the model, world export prices for India are adjusted to reflect US tariff increases, while India’s average tariff collection rate (i.e., tariff collected/imports) is adjusted to account for changes in India’s tariff increments. Results of this analysis are presented in Figure 1.

In case of scenario 1, total export of India will fall between 0.17 per cent and 1.99 per cent per year depending on the increase in the US tariff. This will cause an increase in trade deficit, a decline in foreign currency reserve, and depreciation of the rupee. As a result, import demand in India will fall between 0.6 per cent and 5.9 per cent per year depending on the US tariffs (Figure 1a).

This fall in import demand will be higher if India reciprocates with higher tariff (Figure 1a). The currency depreciation has a favourable impact on exports, but costly imports will increase the cost of production in the domestic market and the Indian products will become less competitive in the world market. The decline in exports reduces domestic production, which lowers the demand for primary input, increases unemployment, and a fall in household income. All these contribute to the decline of GDP under both scenario 1 and 2. If the US hikes import tariff by 50 percentage point, India’s GDP will fall by 0.46 per cent per year as compared to 0.62 per cent fall in GDP if India reciprocates with 50 per cent additional import tariff on US (Figure 1a).

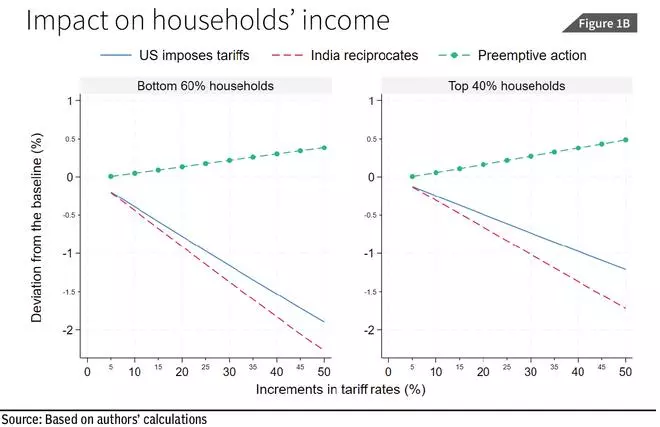

Similarly, India’s reciprocity will have an adverse effect on employment and households’ income as compared to no reciprocity to US tariffs. For example, the fall in employment under scenario 1 would be between 0.1 per cent and 0.9 per cent depending on the tariff rates imposed by US as compared to the fall in employment by 0.1 per cent and 1.1 per cent in scenario 2 (Figure 1a). Again, under scenario 1, bottom 60 per cent of households (in terms of quintile expenditure) will experience a 1.9 per cent income reduction corresponding to a 50 percentage point increase in US tariffs (Figure 1b).

Their income will further decline to 2.28 per cent under scenario 2. Therefore, if India retaliates with higher tariffs, the bottom 60 per cent of households will suffer an additional 0.38 percentage point decrease in income. On the other hand, the top 40 per cent of households will experience a loss of income by 1.21 per cent in scenario 1 and 1.72 per cent in scenario 2, implying an additional 0.51 percentage point decline in income. Therefore, the adverse consequences of reciprocity are greater for the top 40 per cent Indian households compared to the bottom 60 per cent.

To overcome these adversities, if India provides tariff concessions on US exports, India’s GDP could experience an annual increase of up to 0.09 per cent. This growth would be attributed to the additional 50 per cent tariff concessions granted on imports that currently have higher Indian tariffs (Figure 1a).

Policy insights

Based on the above results, we have derived the following policy insights.

Since India is a net exporter to the US, any US tariff rate increment on Indian exports will have an adverse impact on its export, GDP, overall employment and household income in the short run.

Since tariffs are a tax on commodities, it impacts domestic consumers’ budget and contracts demand for commodities. Therefore, if India retaliates with reciprocate tariffs on import from US, the impact on the Indian economy will be more severe. India and the US should find alternative options for mutual benefits through their economic ties.

India’s tariff concessions to the US generate some positive implications on key economic indicators, provided the US does not impose any additional tariff on Indian exports.

Implementing unilateral tariff concession for the US is risky for India as it disrupts international trade relations with other countries. Therefore, India either can revisit its tariff policy to increase global access to the Indian market or can find alternative avenues for trade diversifications.

Strengthening domestic industries through technical innovations can improve efficiency and competitiveness of Indian products in the world market and thus the Indian economy will be more resilient to such strategic shift by its partner countries. However, this requires long term development strategy and investment planning in India.

To conclude, we must acknowledge that, while a single-country model is weaker than a global-level model in capturing global trade diversification and demand shifts in other countries, this rapid assessment provides insights into the short-term consequences on the Indian economy and suggests possible long-term development strategies for India.

The writers are with IFPRI