Investment bankers are set to take home hefty bonuses this year despite a subdued quarter.

The payout could be 125-150 per cent of annual salary, on average, going up to 200 per cent depending on the bank and individual performance.

“At most firms, bonuses this time will be upwards of 125 per cent. Barring this quarter, almost all products have done well this fiscal,” said a banker.

The bonuses are directly correlated to the fees collected. The overall fee pool, in turn, is directly related to the amount of deal activity and the volume of funds being raised.

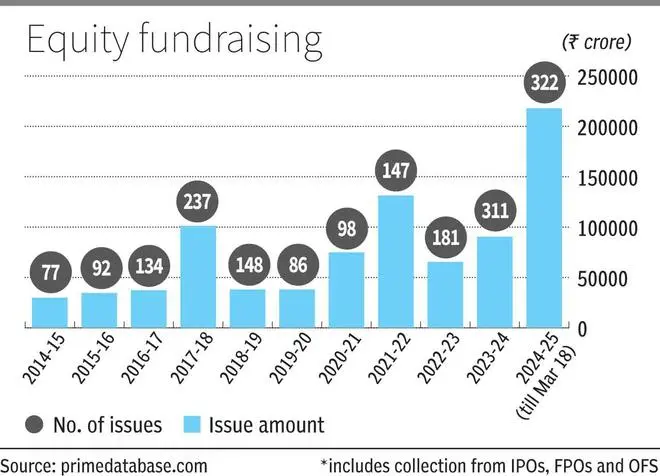

Total equity fundraising so far this fiscal is ₹2.18 lakh crore, over twice the amount mopped up in the previous fiscal. Fees collected through initial public offerings, qualified institutional placements, and block deals is estimated to be over ₹3,400 crore for ECM bankers.

“We have seen quite a few new age tech companies like Swiggy which came to the market in the past year. These firms typically pay more than other companies because of the effort involved. This has helped increase the fee pool,” said Pranav Haldea, Managing Director, PRIME Database.

Banks pocket 2-3 per cent as fees, on average, for managing IPOs, and 1.5-2 per cent for handling QIPs. They can earn up to 1.5 per cent on block deals — 25-50 bps for liquid counters and 100-150 bps for illiquid names.

IPO influx

The influx of IPOs last year has made investors more selective this year. IPO activity could pick up if market conditions stabilise and interest rates soften.

“Fund flows need to settle down. While the pace of FPI selling has slowed, outflows are not helping matters. You have seen muted activity in February and March. If the results season for March is not as dismal as it was in the previous two quarters, we may see things picking up again from April onwards,” the banker said.

The IPO pipeline remains robust, with past two months seeing 43 filings. Forty seven companies have the regulatory nod for an IPO, while another 68 firms are awaiting approval. Together, these could potentially raise ₹1.82 lakh crore.