Jefferies Financial Group, Inc. (NYSE:JEF) has posted its SEC filing for the quarter to end-May 2023, with the document revealing details about the relationship with FXCM.

Jefferies notes that it has a 50.0% voting interest in FXCM, a provider of online foreign exchange trading services, and has the ability to significantly influence FXCM through its seats on the board of directors. During the three and six months ended May 31, 2023, Jefferies contributed additional capital of $5.0 million and $10.0 million, respectively.

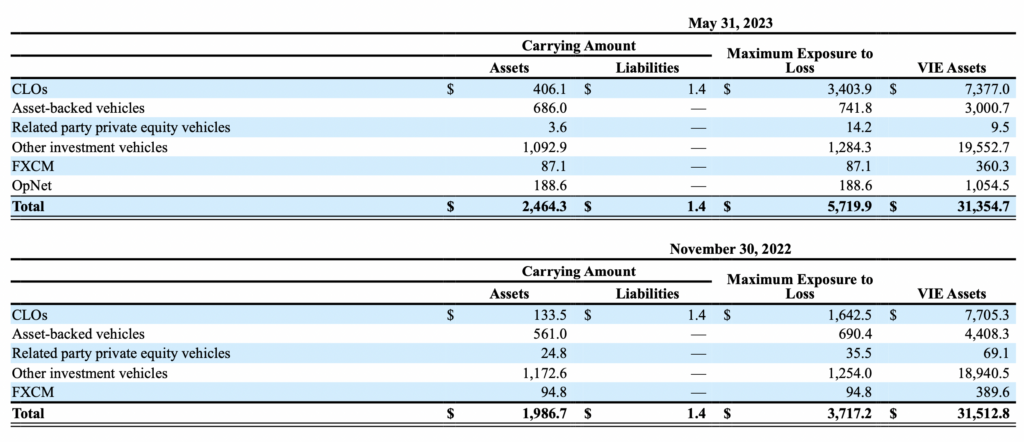

Jefferies has equity interests in FXCM of $46.6 million and $59.7 million at May 31, 2023 and November 30, 2022, respectively.

Jefferies also has a senior secured term loan to FXCM, which is accounted for at a fair value of $38.1 million and $35.1 million, at May 31, 2023 and November 30, 2022, respectively.

The assets of FXCM primarily consist of brokerage receivables and other financial instruments and operating assets as part of FXCM’s foreign exchange trading business.

In March 2023, certain noteholders of Global Brokerage Inc. (“GLBR”) filed an involuntary bankruptcy petition against GLBR and its subsidiary, Global Brokerage Holdings LLC (“Holdings”), which holds a 50% voting equity interest in FXCM.

In addition to all of FXCM’s assets being pledged as collateral to Jefferies in connection with the senior secured term loan, all of Holdings’ equity interest in FXCM is also pledged as collateral to Jefferies in connection with the senior secured term loan.

Jefferies currently intends to seek to lift the automatic stay in the bankruptcy proceeding and to enforce its rights under the term loan, the controlling intercreditor agreement, and related contractual agreements among the parties.

Jefferies believes that the successful enforcement of those rights will result in Jefferies owning 100% of FXCM.