Market volatility has taken a toll on companies that made their debut on the bourses in the recent past.

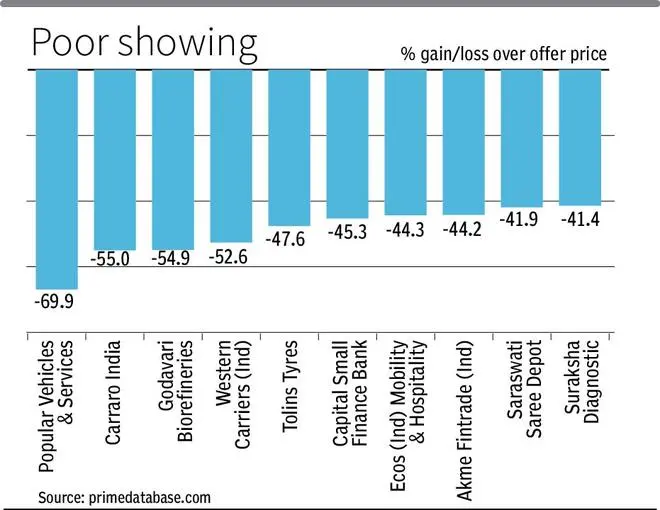

Half of the 100 companies that listed on the mainboard since last year are trading below their offer price, data from PRIME Database showed. Sixteen of these companies of have lost over a third of their market value. Five out of the last 10 companies that listed on the bourses are trading in the red.

Popular Vehicles & Services, which is into sale and service of automobiles, has seen its stock slide 67 per cent. The other top losers include Carraro India and Godavari Biorefineries, both down 55 per cent from the offer price.

Three IPOs hit the market in February compared with six in January and 15 in December, hinting at a slowdown, in the backdrop of a volatile secondary market that has seen the Nifty slip over 14 per cent from its all-time highs.

Sustained selling by overseas investors and the Trump factor has muddied the waters for IPO launches, especially for companies that depend on the US market for revenues or raw material. Uncertainty from global geopolitical tensions and fluctuating interest rates has made investors more cautious, while higher bond yields and a tighter monetary environment have reduced excess liquidity, impacting risk appetite.

“Concerns over high valuations have led many companies to delay their listing plans, fearing a lack of investor enthusiasm. Stricter SEBI regulations on disclosures and pricing have also made companies reconsider their IPO timelines,” said a note by Bajaj Broking Research.

The influx of IPOs last year has made investors more selective this year. IPO activity could pick up in the second half of this year, however, if market conditions stabilise and interest rates soften.

“Despite receiving SEBI approvals, some companies have delayed or paused their IPO listings due to market volatility, weak investor sentiment, and unfavorable valuations. Factors such as global economic uncertainty, fluctuating interest rates, and sector-specific challenges have made firms cautious about their public debut. Many are waiting for improved market conditions to ensure better pricing and investor participation,” the brokerage said.

Despite the current slowdown, the IPO pipeline remains robust, with past two months seeing 43 filings. Forty seven companies have the regulatory nod for an IPO, while another 68 firms are awaiting approval. Together, these could potentially raise ₹1.82 lakh crore.

Thirty of the forty seven companies have received the regulatory nod in the past three months, implying they have have another nine months to launch, considering an IPO validity period of one year.