For four years after Covid, retail investors queuing up to buy mutual funds were the driving force behind India’s stock markets tripling. Mutual fund flows also propped up the markets when Foreign Portfolio Investors (FPIs) sold. But will retail flows into equity mutual funds (MFs) remain resilient if there’s a material and sustained market correction? We now have a chance to test this out.

After rallying between 2020 and 2024, India’s stock indices peaked in September 2024 and have been declining for the last five months. The Nifty50 has lost 15 per cent from its high. Mid-cap and small-cap indices have suffered deeper cuts of 20-25 per cent. One-year returns on most equity MFs are now close to zero or in the red.

This is a good time to gauge how MF investors behave when a bull run gives way to a bear attack. We analysed monthly data from Association of Mutual Funds of India (AMFI) from January 2020 to February 2025 to arrive at these findings.

Investors reduce lumpsums

As the markets have tumbled in the last six months, investors have cut back significantly on their lumpsum investments in equity MFs. This is evident from the gross inflows into open-end equity funds slipping 33 per cent from over ₹81,000 crore in July 2024 to about ₹54,400 crore in February 2025. (We have considered only flows into open-end equity funds in this analysis and not index funds/ETFs due to their institution component.)

However, the markets began to correct only from October 2024, so how come MF investments started moderating from July itself? The correlation becomes clear when you exclude NFO (New Fund Offer) collections from the overall flows. (Monthly NFO collections are lumpy as fund houses launch them in euphoric markets but pause when markets fall.)

Excluding NFOs, it is clear that inflows are significantly influenced by market direction. As the Nifty50 zoomed from 9,800 levels in April 2020 to over 25,000 by September 2024, equity MFs saw a surge in gross inflows from about ₹14,500 crore in April 2020 to over ₹62,200 crore.

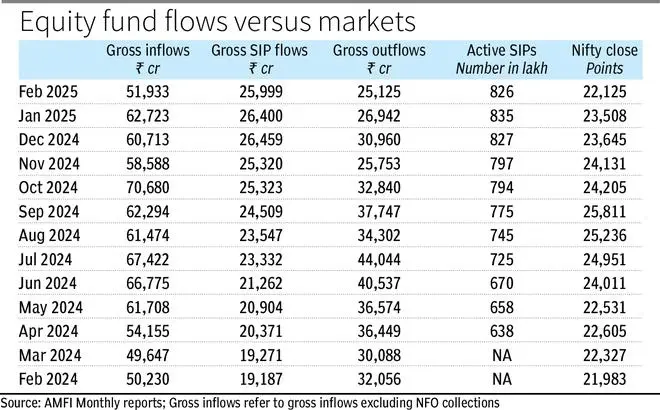

As Nifty50 corrected by 6 per cent in October 2024 and continued to slip, these inflows dwindled until they hit about ₹51,900 crore by February 2025 (see table). Therefore, as the Nifty50 declined 15 per cent, gross inflows (ex-NFOs) dipped about 25 per cent in this period.

While investors have pruned their bets as the markets tanked, February 2025 inflows of over ₹51,900 crore were still healthy from a historical perspective. Monthly inflows into equity MFs averaged only about ₹40,000 crore in FY24 and ₹28,000 crore in FY23 and FY22.

SIP investments hold up

Gross inflows into MFs are made up of both lumpsum investments (one-offs) and SIP instalments. Further analysis shows that almost all of the fall in equity inflows during the last five months came from investors cutting back on lumpsums.

As the Nifty soared from about 21,000 to 25,000 levels between February and September 2024, monthly flows via SIPs rose from about ₹19,200 crore to ₹24,500 crore. As a correction started from October, SIP flows continued to rise reaching over ₹26,400 crore by December 2024. As the correction continued, they flat-lined at about ₹26,000 crore in January/February 2025. Therefore, SIP flows have not really contracted during the 15 per cent market decline (broader markets have fallen even more at 20-25 per cent).

New sign-ups wane

AMFI also puts out monthly numbers on new SIPs registered and old ones closed. These numbers have sparked some alarming headlines on how SIPs are drying up because SIP closures are overshooting new sign-ups. But this is based on misinterpretation of data.

AMFI data throws up two trends. One, as markets fell, fewer investors signed up for new SIPs. As the Nifty50 shot up between January and September 2024, new SIPs registered soared from 49.8 lakh to 66.4 lakh per month. As markets wobbled, they fell to 44.5 lakh by February 2025. This is a 33 per cent decline from September.

Two, investors also closed more SIPs in the correction. Discontinued SIPs shot up from 40.3 lakh to 54.7 lakh between September and February. In January and February 2025, SIP closures were much higher than new SIPs registered. To be sure, this is not very mature behaviour. SIPs work better when markets tumble so investors should ideally be signing up for more SIPs and not closing them in a correction.

This has set the alarm bells ringing on whether SIP flows will soon dry up. But we are a long way away from this. Some SIP closures are a normal part of the investing journey because when investors meet targets or their investment tenure runs out, SIPs are automatically discontinued.

More important, it is necessary to look at SIP addition and closure numbers relative to the outstanding stock of SIPs with the industry. In February 2025, the Indian MF industry had over 834 lakh actively contributing SIP accounts. New registrations and closures each month represent changes to this stock. Looking at SIP numbers from this perspective, new SIPs registered in February added 5.3 per cent to the stock of SIPs already running. February closures reduced the stock of SIPs by 6.5 per cent.

Net-net, therefore, the number of SIPs in the industry fell by just 1 per cent in February 2025 to 826 lakh. This explains why the churn in SIPs did not dent the overall SIP flow of over ₹25,000 crore very materially.

It also needs to be remembered that MF investors do not behave like a herd. When markets fall, seasoned investors are likely add to their SIP amounts, even as newbies get cold feet. Data from the CRISIL-AMFI Factbook show that 21 per cent of SIP assets are held by seasoned investors who have held on for 5 years or more.

During a very sharp fall in the market, seasoned investors will likely put in larger lumpsums while newbies hold back. The extent of support the market will get from their actions will depend on who has more clout. During the Covid crash of March 2020 when the Nifty fell 23 per cent in a single month, gross inflows into equity funds spiked to ₹30,100 crore from ₹24,700 crore the previous month.

No panic redemptions

The above analysis suggests that SIPs hold up, while lumpsum inflows into equity MFs dwindle in a sustained correction. But what about withdrawals from equity funds? Do investors pull out in panic when markets decline?

Data suggests they don’t. Between February 2024 and July 2024, as markets soared to new highs, redemptions rose steadily from ₹32,000 crore to ₹44,000 crore. But as markets began correcting from October 2024, redemptions have waned. Gross pullouts for February 2025 were at ₹25,125 crore — the lowest in 14 months. This suggests that investor book profits when markets hit new highs, but do not indulge in panic pullouts, when they crash. This could be a sign of maturity or simply loss aversion — the reluctance to convert a ‘paper loss’ into a real one.

Whatever the reason, it suggests that MF investors may not force selling by domestic institutions, should the current market fall extend.