Budget 2025-26 announced a slew of measures which include, among others, changes in the income tax slab and raising the income tax exemption limit to ₹12 lakh. Recently, the Reserve Bank of India also announced a repo rate cut of 25 basis points to 6.25 per cent, a first in the last five years. Let us analyse how these measures unfold for the Indian economy during FY 2025-26.

Tax announcements could be perceived as fiscal policy, and, rate cut, monetary policy. Both fiscal and monetary policies could be used to stabilise the economy. The tax reliefs will leave money in the hands of the public which would lead to either an increase in savings or in private sector investments in the economy. Private sector investments are a more powerful tool than public investments to increase output and employment, as the latter may at times crowd out private investment.

India is ranked third globally in the start-up space, thanks to its large talent pool. The recent policy measures should not only facilitate the start-up ecosystem but also investments from other well-established global companies, leading to increased foreign direct investment (FDI).

The RBI rate cut will ensure availability of more funds in the banking system, which will result in competitive lending rates. This will give a boost to private sector investment, especially from households which will get loans at discounted price for housing and other income generating assets. Further, this may also indirectly reduce the price of products offered by the business community, as one of the key factors in their production process, namely, interest rates, will also get reduced. Effectively, there might be a general reduction in price level in the economy in the second half of the coming financial year, thus bringing down inflation.

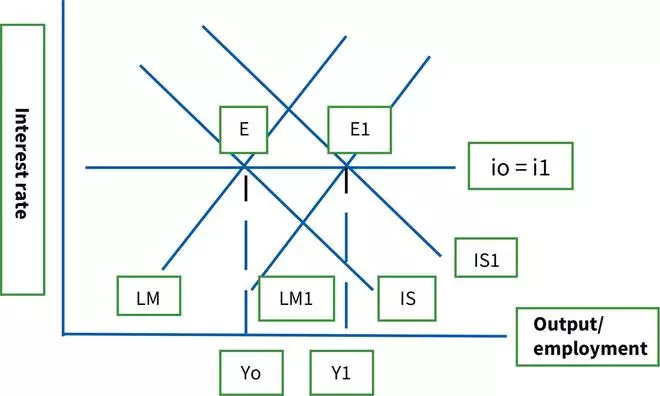

The effect of this fiscal-monetary boost to the economy can be well-explained with a theoretical proposition called the IS-LM model ( of product and money markets in the Hicks-Hansen framework), which is represented in the diagram.

Interest rate effect

In the diagram, the IS schedule represents the equilibrium of the product market. It shows the combinations of interest rate and income levels where saving-investment equality takes place so that the product market of the economy is in equilibrium. It is also termed as “real sector” equilibrium. Similarly, LM (L for demand and M for money supply) schedule shows the combinations of interest rates and levels of income where the demand for money (L) and supply of money (M) are equal such that the money market is in equilibrium.

A tax cut as initiated now or an increase in government spending shall lead to expansion of demand and results in the IS curve shifting to the right, which may increase the interest rate. However, this is offset by the increase in money supply due to the rate cut by the RBI — that is, a shift from LM to LM1 — which maintains the equilibrium position of the economy at E1 instead of E with same interest rate, with a higher output or income to the economy at Y1 instead of Yo (initial equilibrium output). Higher output or income indeed indicates higher employment in the economy.

There is already a perception that reduction in repo rate may result in outward flow of capital from the economy and may depreciate the rupee. This is indeed a fallacy, as is clear from the above proposition that increased output in the economy results in increased exports, that too at a competitive price due to the value of the rupee at present.

From a theoretical perspective too, exchange rate depreciation works to attract world demand and raise domestic output. Increased exports, in the long run, lead to appreciation of the rupee against the dollar, as much of our exports are denominated in dollars. This effect could be more visible in the second quarter of FY 2025-26 as the tax cut comes into from April 2025. However, individual financial planning might have already kick-started in this regard. Further, interest sensitive capital can never be an indicator for sustainable growth of any economy across the world.

Major facilitator

The Budget announcements, especially with regard to micro, small and medium sectors, start-up schemes, credit guarantee for exports, etc, could be a major facilitator, as they will ensure that savings and investments flow towards these productive sectors of the economy. Further, the economy could also witness inward FDI in light of a favourable investment climate in the economy, more so from the second quarter of the next financial year. Further, the current depreciation might have already shifted demand from foreign goods towards domestic goods, as the former is indeed costly at this point of time.

A coordinated policy effort like the recent fiscal and monetary policy mix may further improve the targeted growth of the Indian economy for the next financial year. The positive trends may be clearly visible from first quarter of FY 2025-26.

The writer serves as Director at the Ministry of Finance. Views are personal