The Indian equity market has seen a selling frenzy by foreign institutional investors (FIIs) over the last few months. The current week has also seen heavy selling as the tariff war appears to be escalating. Rupee weakness against USD is also playing spoil sport.

According to ACEMF data, FIIs have sold off a net amount of ₹1.1 lakh crore in the cash segment during the past six months. From their latest peak on September 26, 2024, the frontline indices — the Nifty 50 total return index (TRI), Nifty Midcap 150 TRI, and Nifty Smallcap 250 TRI, have corrected by roughly 11 per cent, 13 per cent, and 15 per cent, respectively.

Bucking the trend

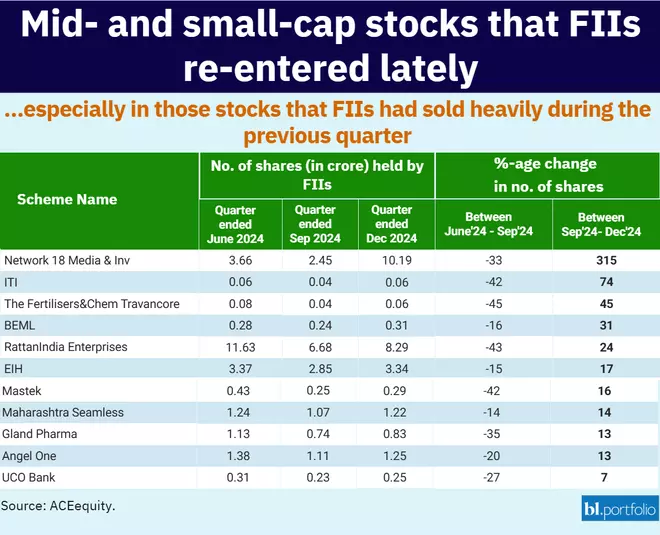

Despite a massive sell-off, FIIs have increased positions in certain stocks during the quarter ended December 2024. The shareholding pattern data provided by ACE Equity has the top small- and mid-cap companies, with FIIs showing renewed interest in those that they had sold heavily during the quarter ended September 2024. The stocks are shortlisted based on the difference in the percentage change of the total number of shares owned by FIIs during the September quarter and December quarter

While how and whether they have changed their stance in the current quarter will be known only by next quarter, this is what they have done for the December quarter