The Reserve Bank of India’s recent 25 basis point rate cut in its February Monetary Policy Meeting has enhanced the appeal of bonds, with expectations of further rate cuts in the months ahead. This presents a favourable opportunity for investors to secure high yields with a possibility of capital appreciation from high-quality debt instruments. Corporate bond spreads are currently the most attractive in the 3 to 4 year bucket.

For those with a 3-5-year investment horizon, the Nippon India Corporate Bond Fund stands out as a notable option. Investing in top-tier AAA-rated PSU and corporate bonds, the fund provides an opportunity to achieve higher yields compared to government securities (G-Secs), along with potential gains in a declining rate environment.

Why corporate bond funds?

Global interest rates seem to have peaked out, with many central banks either on hold or well into the rate-cutting phase. The RBI may also consider further rate cuts, given the easing inflation trajectory, slower economic growth and prudent fiscal policies. This could unlock capital appreciation opportunities driven by rate reductions. Highly rated corporate bonds are a good way to benefit from this.

The spreads between AAA-rated corporate bonds and similar G-secs have widened from 40-50 basis points (bps) to 70-90 bps in recent months for 3-5 year tenor, driven by decreased G-sec supply and tight liquidity. Corporate balance sheets in India are also in good shape with leading companies sitting on low leverage. Corporate bond funds, which primarily invest in AAA-rated bonds, henceforth offer a compelling investment option.

High-quality portfolio

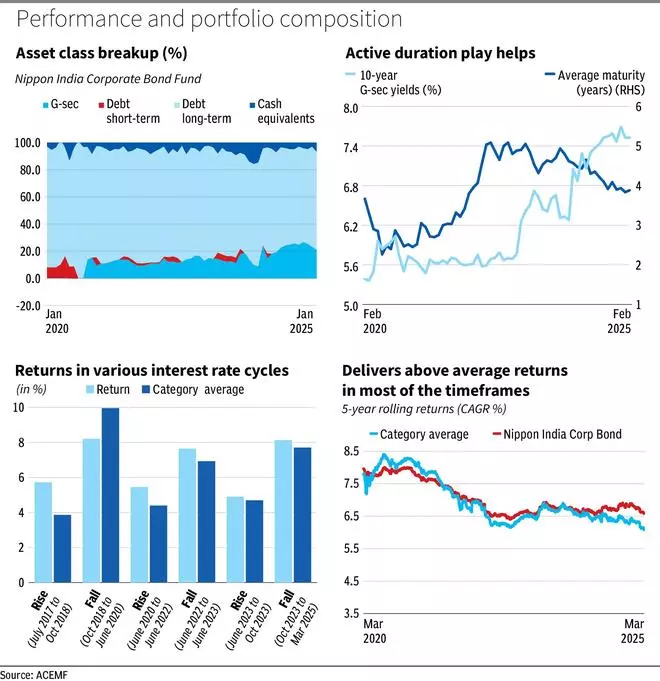

The Nippon India Corporate Bond Fund stands out in its category due to its high-quality portfolio and active duration management. Over the past three years, the fund has allocated around 20 per cent of its assets to long-dated G-secs, which offered a more favourable risk-reward profile compared to corporate bonds, particularly due to their inclusion in global indices. Approximately half of the portfolio is invested in AAA-rated bonds from financial firms and other companies, such as those issued by ICICI Home Finance and Tata Capital Financial, enabling the fund to achieve higher yields.

Additionally, the fund invests 25-30 per cent of its portfolio in bonds from prominent public sector undertakings (PSUs) like REC, IRFC, and PFC, ensuring low-risk and highly liquid portfolio. This strategy is reflected in its portfolio yield-to-maturity (YTM) of 7.43 per cent as of January 2025, slightly above the category average of 7.37 per cent.

Active duration management

Nippon India Corporate Bond Fund has delivered better returns than the category in both falling and rising rate scenarios. It was among the few funds in its category that proactively reduced the average maturity of its portfolio to around two years in 2021. This move came just before RBI began its rate hiking cycle, when it reversed easing effected during Covid and withdrew the liquidity stimulus from the market. This proactive move helped mitigate potential mark-to-market losses as yields rose. During this period, the fund maintained an allocation of 85 per cent in AAA-rated bonds and 15 per cent in AA and AA+ rated bonds, making it one of the top performers in its category both during the low interest-rate phase of 2021 and the rising-rate phase of 2022.

Following the RBI’s rate hike cycle, the fund extended its duration starting February 2023, increasing its average maturity to 5.5 years. This paid off as 10-year Indian G-sec yields fell from a peak of 7.5 per cent to 6.75 per cent, and AAA PSU yields declined from 8 per cent to 7.5 per cent. Currently, the fund holds a mix of sovereign assets, high-quality PSU bonds, and corporate bonds, ensuring a high-quality portfolio with high liquidity. As per the latest portfolio, the fund allocates 25 per cent to 5-10 year sovereign bonds, 10 per cent to 10-year corporate bonds, and 40-50 per cent to 3-5 year AAA-rated corporate bonds.

On the downside, while the fund stands to benefit from future rate cuts, the trajectory of cuts is by no means certain. Recent global events can add to volatility in foreign investor flows into Indian bonds and lead to more two-way moves in prices. Moreover, in a shallow rate-cut cycle, bond yields may not decline significantly, limiting the scope for yield-driven capital appreciation.

Additionally, expense ratios on top of taxation of debt funds, where gains are taxed at the investor’s slab rate, make them less competitive compared to high-quality fixed deposits. However, investors seeking compounding of returns, with anytime liquidity and diversification may still find these funds appealing.

The fund’s expense ratio for the regular plan is 0.72 per cent, slightly above the category average of 0.70 per cent, while the direct plan’s expense ratio is 0.36 per cent, higher than the category average of 0.32 per cent.

Performance

Performance as measured by five-year rolling returns calculated from the last 10 years’ NAV data shows that the fund delivered an average compounded annual return of 7.1 per cent while the category clocked 6.9 per cent.

The fund holds a five-star rating according to the bl.portfolio MF StarTrack rating. It is a suitable choice for investors with a low to moderate risk appetite and an investment horizon of three to five years.