Natural gas is typically transported in liquid state while it is predominantly used in its gaseous state. Hence, while India imports its natural gas requirements in liquid state — liquified natural gas (LNG), regasification terminals help convert it back to gas and feed it into the grid. And accounting for around 34 per cent of gas supplies and 74 per cent of LNG imports in India, Petronet LNG (PLNG) is a key player in this space.

There are, in total, seven terminals in India, with three more under construction and three in the planning stages. Gujarat State Petroleum Corporation (GSPC) is the only other like-to-like exclusive terminal operator, but, unlisted and proposed to be merged with Gujarat Gas. Other players include the likes of Indian Oil Corporation (IOCL), Shell and Adani Total Gas.

The company has strong promoters in the form of Oil and Natural Gas Corporation (ONGC), GAIL, IOCL and Bharat Petroleum Corporation (BPCL) with shareholding of 12.5 per cent each. It operates two import, storage and regasification terminals currently — one in Dahej and another in Kochi. PLNG, essentially, imports LNG (primarily from QatarEnergy) based on confirmed demand and supplies to domestic players. GAIL, IOCL and BPCL account for bulk of the sales, which then cater to the end-customers.

Having corrected around 25 per cent from its 52-week high in August 2024, the stock currently looks good, trading at 10 times its FY26 earnings. The dividend yield also adds to the comfort, with the current yield at around 3.3 per cent, while the five-year average is at 5.2 per cent.

The Government of India’s push to increase the contribution of natural gas to India’s energy mix to 15 per cent by 2030 from the current 6.5 per cent as of 2023, and the capex underway to expand gas transmission pipelines work in favour of this space. With demand expected to come in from household and industrial segments and increasing adoption of CNG-fuelled vehicles, the inevitable reliance on imports to meet such increasing demand, considering the limited domestic reserves, also add to macro tailwinds. Thus, investors could consider accumulating the stock from here.

Operating metrics

The long-term sales and services agreements with GAIL, IOCL and BPCL help secure committed terminal capacity utilisation up to 14.9 million tonnes per annum (mtpa), which is around 66 per cent of the current capacity. These are backed by long-term purchase agreements with terms and conditions co-terminus with the sale agreements, passing on the entire price risks to the offtaker.

Also, use-or-pay (UOP) contracts for regasification with the offtakers, backed by bank guarantees, meaning either the committed regasification capacity must be utilised by the counterparty or be paid for in any case, present strong revenue visibility for PLNG.

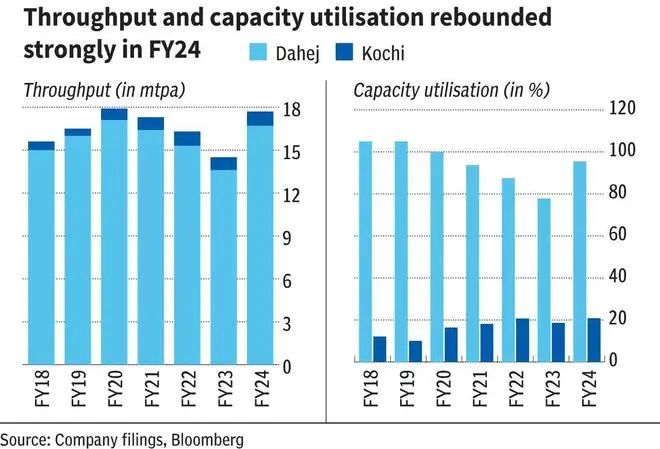

Throughput (essentially, volumes handled) stood at 17.7 mtpa for FY24, up 22 per cent from 14.5 mtpa in FY23, thanks to softening LNG prices from peak in FY23. Carrying the momentum on to FY25, the volumes handled in 9M FY25 has been the highest during the period, improving 6 per cent year on year.

Consequently, capacity utilisation ramped up to 95.5 per cent in FY24 and 100 per cent in 9M FY25, up from 77.8 per cent in FY23, for the Dahej Terminal, while that of Kochi’s also improved 220 bps from FY23, to around 20 per cent both in FY24 and 9M FY25.

Financial metrics

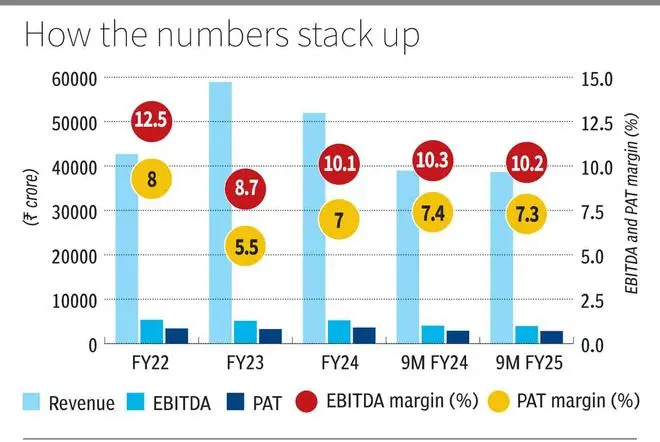

Around 90-95 per cent of the revenue is from pass-through LNG sales, as the company intermediates LNG import and regasification, and hence low on profit margin. However, the income from regasification services, though contributing only around 5-10 per cent of total revenue, forms the bulk of the company’s bottomline due to its high margins.

Though softening LNG prices resulted in revenue dipping 12 per cent year on year in FY24, it was offset by improved offtake, resulting in better capacity utilisation and stable tariffs, helping the company benefit from operating leverage. EBITDA and PAT margin, thus, were up around 150 bps from FY23, which drove EBITDA and PAT up 3 per cent and 11 per cent respectively.

EBITDA and PAT margin during 9M FY25 continued being firm, but EBITDA and PAT were nominally down (around 2 per cent) year on year, despite the highest-ever throughput, due to provisions made against receivables.

The company had a strong net cash position of around ₹7,800 crore as of Q2 FY25.

Expansion and outlook

The strategic position of Dahej Terminal, thanks to the proximity to key demand centres and well-developed pipeline infrastructure connecting it with key supply grids, adds to the competitive advantage of PLNG. It is important to note here that no other terminal in India operates even near 60 per cent of its capacity.

Total storage capacity of the terminal is being increased 37 per cent from the present 1 million cubic meter, expected to be commercialised in the current quarter. Also, the regasification capacity at the terminal being expanded 28.5 per cent from the current 17.5 mtpa to 22.5 mtpa. This is expected to come online in Q1 FY26.

While the Kochi-Mangaluru pipeline has not helped materially improve the volumes for the Kochi terminal, Kochi-Bengaluru pipeline, which is expected to be completed by Q1 FY26, proposed to be linked with the national gas grid, is projected to help improve utilisation levels to 30-35 per cent.

The planned greenfield expansion of a 4-mtpa terminal in Gopalpur, Odisha, is underway. This will help the company geographically diversify with access to a new market. But it could take three-four years to be fully operational from when the construction begins, which is still a long way off.

PLNG is also diversifying into petrochemicals. Expected to be commissioned in 2028, the downstream expansion, though bringing in commodity-specific volatilities, will be a separate operating segment capable of value-accretion to the shareholders. But with the huge capital outlay planned of ₹20,685 crore, effective use of capital will be a key monitorable.