Is real estate back in play for ETF investors? Recent ETF flows data, backed by a surge in pending home sales, suggests that mortgage rate issues may have leveled off and that the tight supply of housing in the U.S. may have reinvigorated the asset class and real estate investment trusts (REITs). As such, it may be worth looking at how active and passive real estate ETFs can play a REIT rebound differently, and the merits and drawbacks of each approach to both traditional home sales and REIT-based income.

Generating a steady stream of income, REIT ETFs also have the benefit of offering a more liquid set of exposures to real estate than other real estate investments. Consider a scenario where a private fund might get stuck holding properties that become uninvestible due to climate change compared to a REIT ETF, with tradeable REIT firm equities offering increased liquidity overall.

To start, investors can consider a pair of strategies from SS&C Alps Advisors, the ALPS Active REIT ETF (REIT) and the ALPS REIT Dividend Dogs ETF (RDOG). REIT launched in 2021 and charges a 68 basis point (bps) fee, offering a non-transparent approach to preferred equities of U.S. REITs, and occasionally other non-REIT real estate operating companies.

See more: “Four Active REIT ETFs for 2023“

REIT’s proprietary methodology, guarded using the Blue Tractor non-transparent model, considers both the intrinsic value of properties in REITs as well as the value of those properties sought by the same REITs.

RDOG, meanwhile, tracks the S-Network REIT Dividend Dogs Index and charges 35 bps to do so, having launched all the way back in 2008. For those who like the potential of REITs but want to add in the current income of dividends to buoy their portfolios overall, RDOG is one to consider.

Whereas REIT is non-transparent and strives to limit front-running, RDOG instead applies the “Dogs of the Dow” investment strategy to an equal-weighted index that selects the five highest-yielding U.S. REITs in the nine REIT segments. RDOG has seen stronger annual dividend yields than its ETF Database category average and its FactSet segment average, with an annual yield of 5.41% compared to 4.1% and 4.2%, respectively.

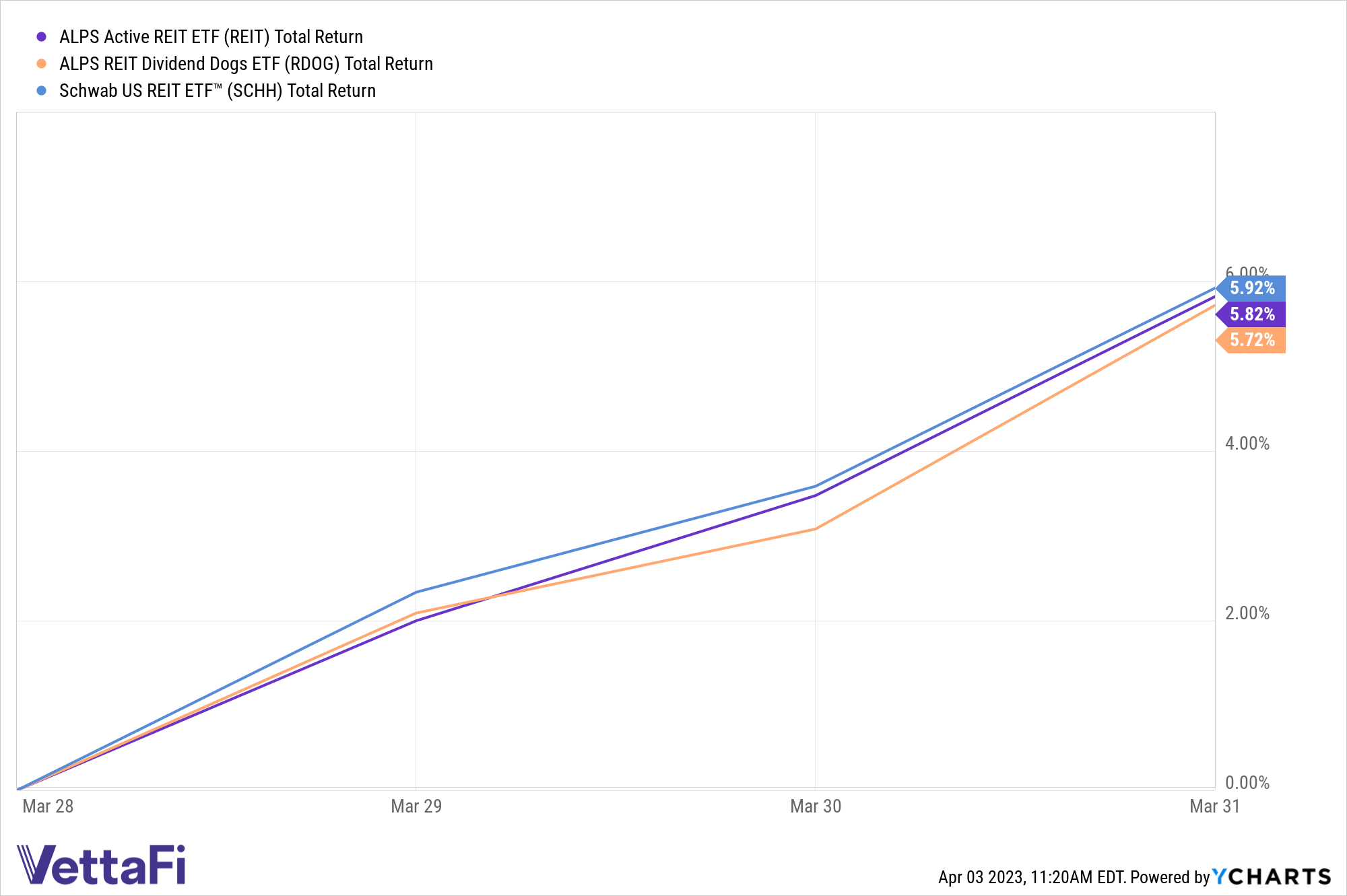

Finally, it may be worth looking at how this pair of REIT ETFs operates compared to one of the biggest funds in the REIT ETF space, the Schwab U.S. REIT ETF (SCHH). SCHH charges just 8 bps and tracks the Dow Jones U.S. Select REIT Index. Adding $10.7 million in net inflows over the last five days, it has performed well over the last five days according to the above chart.

When compared to the duo of RDOG and REIT on a YTD basis, however, the performance diverges and offers another view into how these strategies might respond in a REIT rebound environment.

With a possible recession looming this year, and a Fed that seems set to fight inflation no matter the cost, real estate and a REIT rebound would be a welcome sight for many investors. RDOG, SCHH, and REIT offer different ways to approach the space and may be worth keeping an eye on the weeks ahead.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.