The bank “crisis” that stormed the headlines looks much smaller in hindsight. That doesn’t mean that banks’ impact on markets in 2023 has meaningfully lessened, however. While markets may be distracted by rising rates and AI, the “bank walk” phenomenon has a role to play. Per WisdomTree’s mid-year outlook, the bank walk shifts of capital out of bank accounts and into money market funds. That could limit bank lending amid a broader credit crunch that may boost the case for value ETFs.

WisdomTree’s outlook update notes, for example, the Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS). The survey notes that credit has tightened for commercial and industrial (C&A) loans to small businesses for “only” four quarters. Per the outlook, that may only be the start as markets only really appreciate tightening in the second year. That may prove helpful to more defensive, value concepts even before considering the bank walk.

See more: “No FOMO for Core Investors”

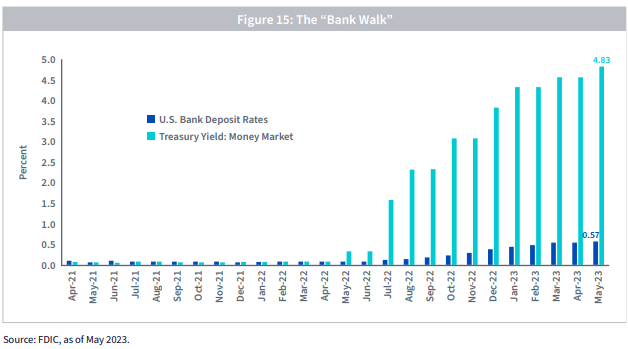

The bank walk that might limit credit further, doesn’t just represent fear, however, as much as opportunity, per WisdomTree. Money markets are paying far more than the national average deposit rate, 4.83% to 0.57%. On a fundamental level, if that decreases the number of deposits, that means fewer loans. Even weaker bank lending would make firms with stronger balance sheets and other fundamental strengths stand out more.

Find the Right Value ETFs

Per WisdomTree’s “Value for the 2020s” theme, markets may be in the process of a multi-year rotation into value. That would position value ETFs for a better outlook. That includes the intriguing case of the WisdomTree U.S. AI Enhanced Value Fund (AIVL). AIVL actively invests in value opportunities by using a proprietary, quantitative AI model. The ETF considers factors like fundamentals and market sentiment to choose 60-190 stocks, capped at 6% per security.

Actively managed, AIVL can respond to changes in the market environment nimbly. The ETF charges 38 basis points and is nearing $400 million in AUM. The ETF has beaten its ETF Database Category Average over the last month. It could present an interesting opportunity for those investors who believe that bank pressure could strengthen the case for value ETFs this year and next.

For more news, information, and analysis, visit the Modern Alpha Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.