Investment strategies based on profitability metrics have outpaced the Nifty 50 Index, a study highlighting factor strategies by Capitalmind Financial Services Pvt Ltd has indicated.

Profitability metrics — such as gross profits to assets and return on equity — provide a data-driven and scalable approach to quality investing, provide excess returns with manageable risk and hold long-term potential despite high valuations, the study revealed.

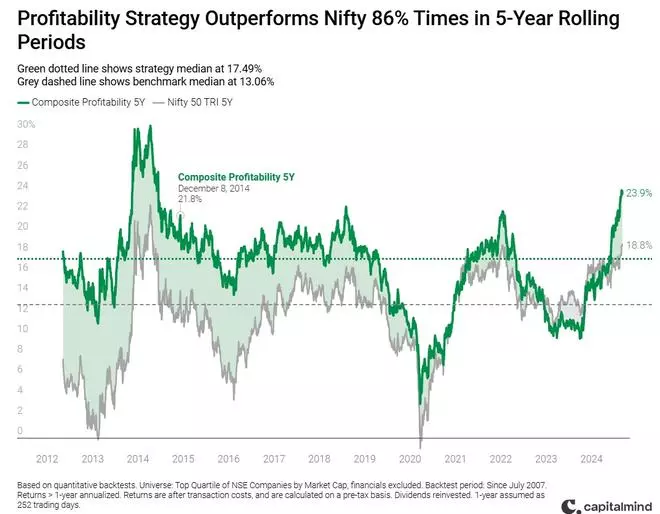

Capitalmind report on profitability factor outperforms Nifty in 5-year rolling period

Factor strategies include momentum, profitability, value, and low volatility. They involve selecting stocks based on specific characteristics and consistently applying these criteria to build diversified portfolios.

According to the Capitalmind research, high profitability companies generate surplus capital and they tend to have strong competitive advantages and less reliance on external capital. The study reflected that profitability-based strategies typically favour defensive sectors, offering resilience during economic downturns or market corrections, and a stable portfolio through market volatility.

The study demonstrated that factor strategies based on profitability metrics have historically outperformed the Nifty 50 index, particularly over rolling periods, despite sub-par performance in recent years.

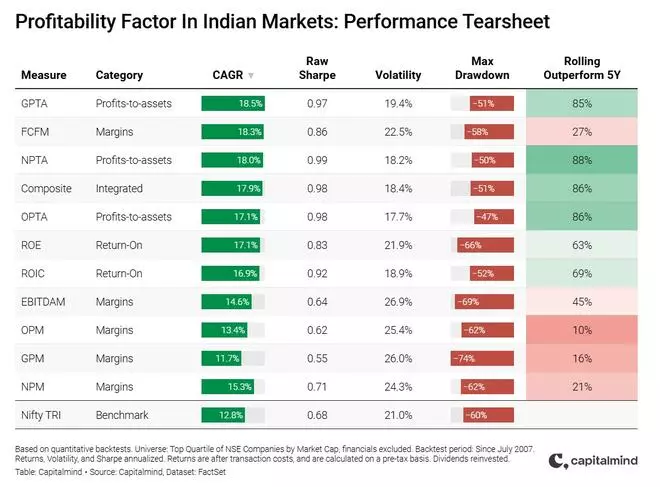

Capitalmind report on profitability factor in India markets

An investment of ₹100 in the profitability-factor portfolio based on a composite measure in July 2007 would have grown to ₹1,765 today, providing an annualised return of 17.9 per cent, compared to ₹810 with an annualised return of 12.8 per cent in the Nifty 50.

The report highlighted that the Nifty 50 experienced a 60 per cent drawdown during the Global Financial Crisis of 2008, while the profitability strategy faced a milder 51 per cent drawdown, recovering faster.

However, Capitalmind suggested a multi-factor portfolio approach, integrating profitability with other factors like momentum and low volatility that could improve long-term returns.

Indian investors are yet to explore the potential of profitability factor investing, according to Divyansh Agnani, Research Analyst at Capitalmind Financial Services.

“Of the ₹30,778 crore invested in style-based passive mutual funds, only ₹1,817 crore is allocated to Profitability or Quality styled funds. This is a curious disconnect, given the demand for Quality funds in the active funds category. Our analysis suggests that high valuations, which active fund managers have the flexibility to counteract, may be a key factor,” Divyansh Agnani added.