Quality Power Electrical Equipments (QPEE), a company specialising in power equipments and solutions across transmission and distribution (T&D), is out with its IPO which is open until February 18. The IPO is a mix of fresh issue and offer for sale to the tune of ₹225 crore and ₹633.7 crore respectively, totalling to ₹858.7 crore. The IPO stands subscribed 62 per cent as at the end of day one.

Promoter stake reduces from 100 per cent to 73.9 per cent post-IPO.

Of the fresh funds raised, ₹117 crore would fund the acquisition (51 per cent stake) of Mehru Electrical and Mechanical Engineers, a notable player in instrument transformers, ₹27.2 crore towards capex and the remaining to fund inorganic growth and other general corporate purposes.

QPEE is one of the few global manufacturers of high-voltage critical equipment that goes into power transmission and power automation.

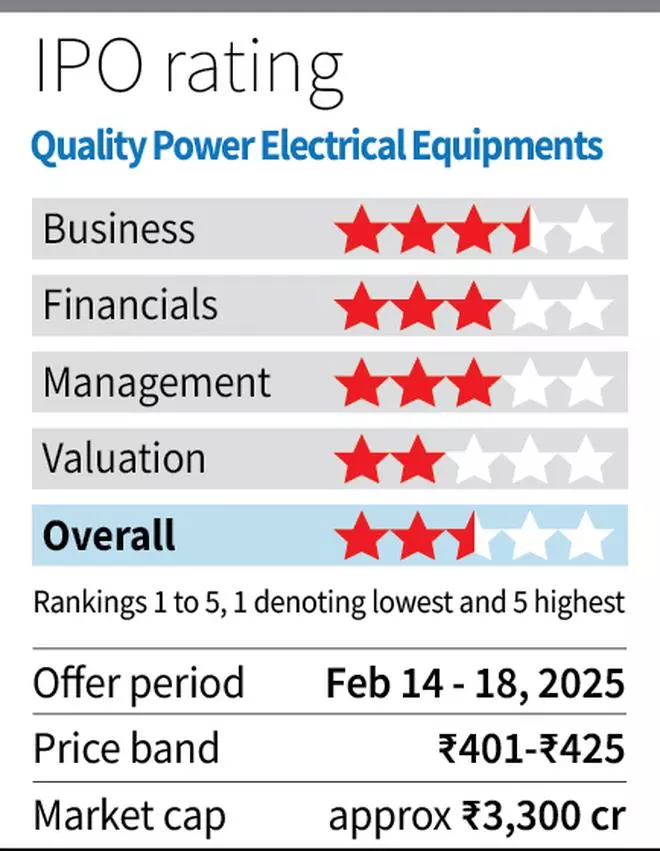

While on the face of it, QPEE is valued at 33 times (31 times including Mehru financials) its annualised FY25 earnings; this includes a high ‘other income’ component in its net profits. However, considering adjusted earnings, after excluding non-operating income, PE stands at an expensive 46 times (43 times including Mehru financials).

Closest competitors — GE T&D India, Transformers & Rectifiers (India) and Siemens, are trading at 68.5 times, 62.4 times and 60.8 times respectively, their FY25 earnings. Hitachi Energy is trading at 152.5 times its CY24 earnings. While this might make QPEE’s valuation relatively cheaper, it remains expensive on an absolute basis.

While QPEE looks cash-rich and the reason for IPO, as quoted by the management, is the better visibility that listing brings in, absolute valuation is on the expensive side, especially given the cyclical nature of its business. Industry tailwinds, focus on R&D and global footprint work in favour. But given the valuation, investors can give the IPO a miss, and wait and watch for now.

The business

The demand for power equipment going into High Voltage Direct Current (HVDC) and Flexible AC Transmission Systems (FACTS) is expected to grow at a CAGR of 75 per cent globally and 60 per cent in India during FY24-28 (per a Care Edge Research Report). This would help regulate the stress on the power grid owing to rising contribution from renewable energy and control transmission losses with expanding cross-border and elongated transmission lines.

QPEE fits right here with product offerings such as power reactors, transformers, line traps, instrument transformers, capacitor banks, converters, harmonic filters, reactive power compensation systems, STATCOM and static VAR compensator systems (SVC), largely catering to HVDC and FACTS technologies.

The company has two manufacturing facilities in India and one in Turkey.

Overseas to domestic business mix is at 75:25 for the company, and it is expected to remain the same in the near-to-medium term. QPEE has footprint in over 100 countries across Asia, West Asia, North America, South America, Australia and Europe.

Clientele disclosed includes GE T&D, Hitachi Energy and Kalpataru Projects International. A few companies feature in the list of both customers and competitors, and QPEE supplies and competes with them across various product segments and geographies.

The top-three customers contribute around 30 per cent of the sales while the top 10 contribute around 55 per cent, meaning customer concentration reduces beyond the top three.

The company has acquired three companies since 2011 to expand its product offerings and the proposed acquisition would add to the list. Mehru’s (based out of Rajasthan) specialisation in instrument transformers and strong presence in South-East Asia and Africa is quoted to be the rationale for the acquisition.

Financial metrics

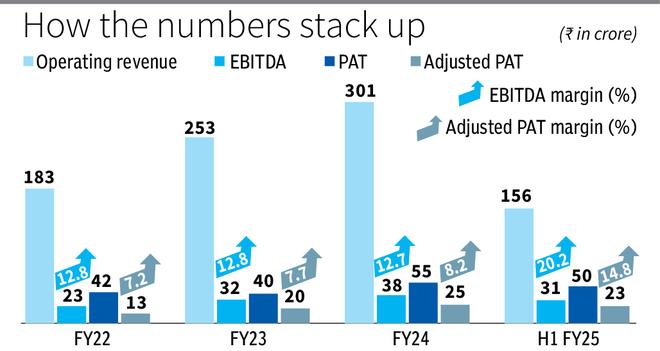

Revenue / EBITDA / PAT have grown at 28 per cent / 28 per cent / 15 per cent CAGR over FY22-24 organically.

PAT margins have exceeded EBITDA margins since FY22, thanks to non-operating income contributing to more than half of PAT. Interestingly, non-operating income contributed to more than 50 per cent of the PAT for all the reported periods. Although adjusting for the same, core PAT has also been on an increasing trend.

H1 FY25 saw revenue, EBITDA and PAT at 52 per cent, 82 per cent and 94 per cent respectively of FY24’s annual figures. Profit margins have been rising sequentially on account of operating leverage arising from cross-selling and favourable demand scenario as observed with competitors too.

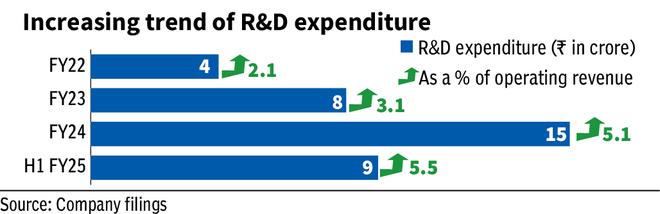

Research and development (R&D) expenditure has been consistently increasing, and the same as a percentage of revenue has risen from 2.4 per cent in FY22 to 5.8 per cent in FY24, despite the rise in revenue. This could aid in the long run by helping in both enhancing the existing product profile and adding new products. QPEE is also one of the very few players having its own test and research lab, certified by NABL (National Accreditation Board for Testing and Calibration Laboratories), which helps with the profile while sourcing new customers.

Customer stickiness on account of the proven track record, considering the criticality of the products, is another factor that clicks. With proven track record across countries and business in India especially picking up after regulatory clearances from PowerGrid Corporation of India, QPEE looks well-placed to attract more orders.

Key monitorable

The company has cash and bank balances (current and non-current) to the tune of ₹77.4 crore, around 19 per cent of the total assets, as of September 2024 and historically too, balance sheet has been loaded with idle cash. Hence, interest income contributes to 30 per cent of PBT.

This idle cash also adds up to more than the value of fixed assets in the books across all the reported periods. Though the net cash position is favourable and the management stated that the cash will be utilised for future R&D, capex and war-chest for future acquisitions, utilisation of this cash will be a key monitorable.