The Reserve Bank of India has conducted several dollar-rupee buy/sell swap auctions and open market operations since January 2025. These measures help the RBI to manage volatility in the forex market and infuse liquidity into the banking system. These policy actions supplement the interest rate cut announced by the RBI governor in early February. An interest rate cut reduces the cost of borrowing and encourages domestic firms and households to spend more. However, if liquidity in the banking system is inadequate, a rate cut may not be effective as banks’ ability to lend money will be limited.

To help the banks in such a scenario, the central bank generally buys government securities from the banks in exchange for domestic currency, thereby increasing liquidity in the system. The central bank’s buying (or selling) of government bonds to influence liquidity in the banking system is called an open market operation (OMO). In an OMO, when the RBI purchases government securities to infuse liquidity, the secondary market yields of the government securities purchased are also affected.

Swap auctions

Along with the conventional OMOs, the RBI has also conducted several dollar-rupee buy/sell swap auctions. A buy/sell forex swap by a central bank is an instrument where the central bank buys foreign currency from a commercial bank in exchange for domestic currencies, with a commitment to reverse the transaction at a predetermined future rate and date. For example, domestic liquidity in the banking system increases when the RBI purchases US dollars from commercial banks against rupees.

Moreover, as the RBI is buying dollars, these purchases temporarily add dollars to the RBI’s forex reserve holdings. In a forex swap, the RBI is also committing to reverse the transaction at a future date, selling back the dollars against rupees to the commercial bank at a predetermined price. The predetermined price carries a premium, which is determined through an auction conducted by the RBI.

The rationale for conducting these forex swaps is twofold. The first objective is domestic liquidity infusion, as the purchase of dollars by the central bank from commercial banks can address the problem of liquidity shortage in the banking system. However, one needs to remember that with a swap transaction, the impact of liquidity infusion gets reversed on the settlement date.

The second and possibly the more important objective of the forex swaps is the management of exchange rates.

The dollar-rupee buy/sell swaps add dollars to the RBI’s forex reserve and improve the ability of the central bank to intervene in the forex market.

The spate of forex swap auctions announced by the RBI is possibly necessitated by a sharp depreciation of the rupee in the last few months.

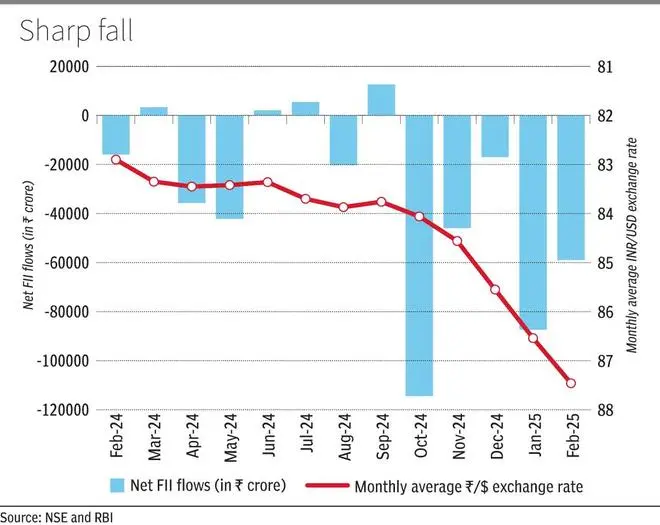

Due to several economic and geopolitical reasons, most emerging markets, including India, are experiencing a massive outflow of foreign portfolio capital. For example, since September 2024, India is experiencing large net outflows of FII money. It has put pressure on the exchange rate, and the rupee sharply depreciated from 83.5/dollar on September 22, 2024, to cross 87.5/dollar on February 7, 2025 (chart). Though the rupee is officially a floating exchange rate, and the RBI explicitly refrains from targeting specific exchange rate levels or bands, the RBI does intervene in the forex market to manage excessive volatility and ensure orderly market conditions.

Given the sharp and continuous depreciation of the rupee, the RBI had to sell dollars and buy rupees in the spot market. By increasing the supply of dollar in the spot market, the RBI tried to reduce the depreciating pressure on the rupee.

But, as the RBI is buying rupee for dollar, this transaction also impounds rupee liquidity from the domestic market. To alleviate this liquidity strain in the domestic market, the RBI participates in the forex swap segment, effectively shifting the liquidity pressure from the spot market to longer maturity, which could range from one month, two months, three months, six months, one year, or even three years.

It is notable that RBI started with a six-month swap in January 2025 and then switched to longer maturity swaps in the subsequent auctions.

Common objective

Therefore, the OMO and the forex swap announced by the RBI fulfil one common objective, which is to ensure that any liquidity shortage does not constrain the domestic banking system. Additionally, the RBI also used the forex swap to ease the pressure on the rupee by reducing the forward premia. The shift to a longer settlement period by the RBI may indicate that the RBI expects the uncertainty in the forex market to continue for some more time.

These two policies have tried to create a pro-growth policy environment by infusing durable liquidity in the banking system and reducing volatility in the forex market. These measures are aimed at reversing the recent slowdown in India’s real GDP growth. It remains to be seen how these policies lead to actual credit offtake in India.

The RBI measures have also led to a decline in yields of shorter-term bonds. However, the yields of 10 years or longer bonds have not been affected. The RBI may need to take some actions to reduce the yield on longer-term bonds.

Geopolitical developments are also helping the RBI. Over the last few days, the dollar has weakened somewhat, and it has helped stabilise the rupee.

The RBI policy measures and lower uncertainty about US government policies have also led to a sharp decline in the one-year dollar/rupee forward premium. It may help foreign currency borrowing by Indian firms besides stabilising the exchange rate.

However, net FII outflows continue. Significant tensions and policy uncertainties remain in international economics and geopolitics. In such volatile times, any global disruption can trigger a collective panic among foreign investors.

The RBI needs to tread carefully to contain inflation pressures while safeguarding growth, particularly when the government has re-oriented policy priorities by stimulating domestic consumption through tax cuts.

Pal is with IIM Calcutta, and Sanati is an Associate Professor with National Institute of Bank Management, Pune