The rupee has been knocked down badly ever since Donald Trump got elected as the US President in November. From around 84 in November, the domestic currency tumbled to a new low of 87.95 against the dollar earlier in February.

This was a sharp 4.5 per cent fall in just a little over three months. The rupee is currently at 87.51.

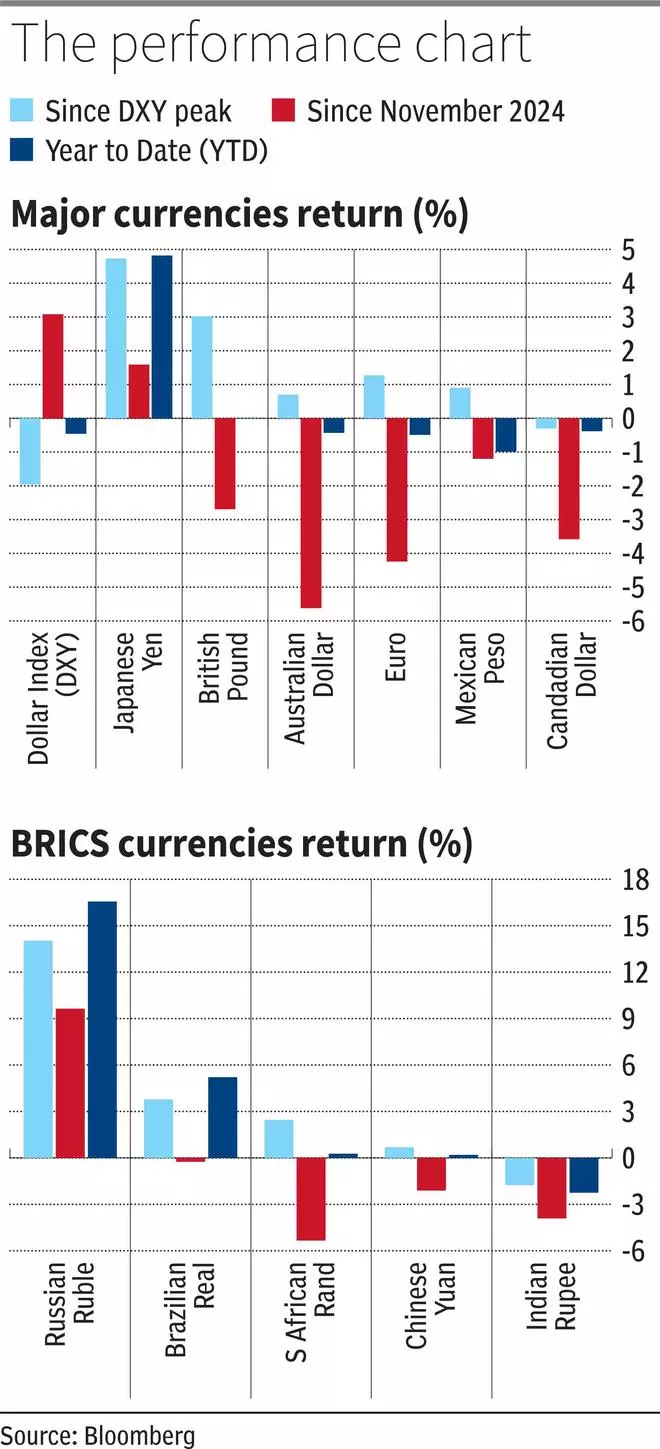

Among the BRICS (Brazil, Russia, India, China, South Africa) countries, the rupee is the second worst performer since November. The South African Rand (ZAR), down 5.5 per cent, has been the worst hit during this period whereas the rupee is down about 3.9 per cent.

Fear of the tariff war, which jolted emerging market currencies in 2018 too (during Trump’s first tenure or Trump 1.0), is one of the major reasons for the rupee’s under-performance this time as well apart from other factors.

Among the major currencies, the Australian dollar (down 5.63 per cent) and the Euro (down 4.25 per cent) are the most hit.

The Japanese Yen has risen about 1.6 per cent against the dollar since November.

Diverging trend

The dollar index peaked around 110 in mid-January and declined 2 per cent from there to 107.50 now.

The emerging market currencies had recovered well during this period from their lows.

But the fall in the greenback has not aided the rupee’s recovery.

The domestic currency is down about 1.8 per cent during this period.

The Chinese Yuan has risen about 0.9 per cent and the South African Rand is up 2.2 per cent since mid-January, the time dollar index peaked. Indeed, the Brazilian Real has surged about 3.8 per cent in this period.

To the contrary, the sell-off in Indian equities on the back of strong foreign money outflows has been weighing on the rupee.

That continues to keep the domestic currency under pressure inspite of the fall in the dollar index.

Foreign Portfolio Investors (FPIs) have pulled out about $13 billion from the Indian equity segment since the beginning of this year.

Interestingly, Russian Ruble has emerged a strong outperformer in both time frames (since November and also from mid-January). The Ruble has surged about 10 per cent against the dollar since November and 14 per cent from mid-January — the time the dollar index has started to decline from its peak of 110.

Then and now

In Trump 1.0, China was major target for tariff. The Chinese Yuan tumbling about 10 per cent from 6.3 to 6.98 in 2018 caused a ripple effect on other emerging market currencies.

That led to the rupee weakening from around 63.25 to 74, a sharp 14 per cent fall then.

But things are looking to be different this time as Trump seems to have a wider agenda. Anindya Banerjee, Head of Research-Currency, Commodities and Interest Rates, Kotak Securities Ltd, says, “Tariff was used as a threat to negotiate in the first tenure. But now it is used for encouraging investments into the US and also to increase government revenues”.

Also, this time Trump is targeting all trade partners in the name of reciprocal tariffs, unlike in the first tenure where China was the only major target.

Data from the Department of Commerce show that the US is the top exporting destination for India. About 17 per cent of India’s total merchandise exports goes to the US.

Abhilash Koikkara, Head – Forex & Commodities, Nuvama Professional Clients Group, says, “India’s average net tariff differential with the US is 6.5 per cent. So, India may fall into the tariff war this time post the April deadline”.

Bleak outlook

The rupee continuing to stay weak even after the fall in the dollar index from 110 to 106 is a concern.

That makes the domestic currency more vulnerable to fall especially if the dollar index starts to rise again.

“The rupee can weaken to 90 and even lower against the dollar depending on how much the central bank allow. That risk is there,” says Anindya.

Abilash adds that the dollar index going back to 110, interest rate differential between the US and India and more foreign money outflows can drag the rupee down to 89-90 against the dollar this year.