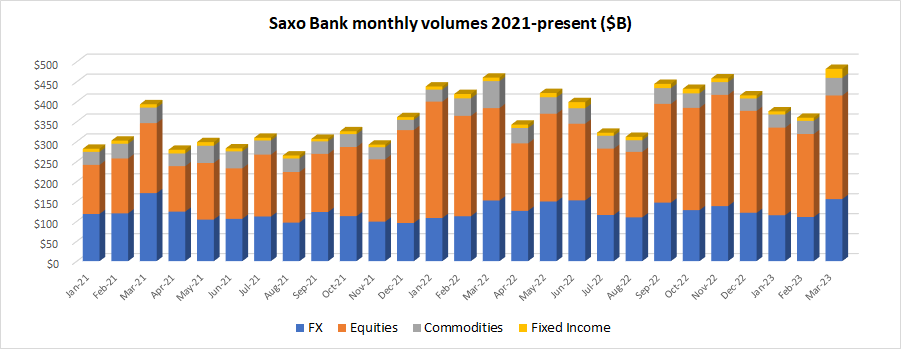

Copenhagen based Retail FX and CFDs broker Saxo Bank just had its best month in more than three years, reporting $482.1 billion in client trading volumes for March 2023.

That marks Saxo Bank’s best monthly result since March 2020, when financial market volatility at the outbreak of the COVID-19 pandemic led to $496.9 billion in volumes for Saxo in March 2020. The $482.1 billion level is also a 34% MoM increase over Saxo’s February volumes of $359.7 billion.

Saxo Bank saw trading volume increases in all of its product categories last month:

- Core FX trading up 40% to $155.6 billion.

- Equities trading up 25% to $259.9 billion.

- Commodities trading up 34% to $44.2 billion.

- Fixed income trading up 180% to $22.4 billion.

We reported in mid January that Saxo Bank is eyeing a traditional IPO in its home market (Nasdaq Copenhagen) following its failed attempt last year to go public via a SPAC merger. Saxo Bank is controlled by China’s Geely Group and Finland’s Sampo.