Sell-downs through block deals were all the rage the last couple of years when equity markets were on a roll but the correction over the past several months has resulted in a sharp fall in sell-downs, according to data.

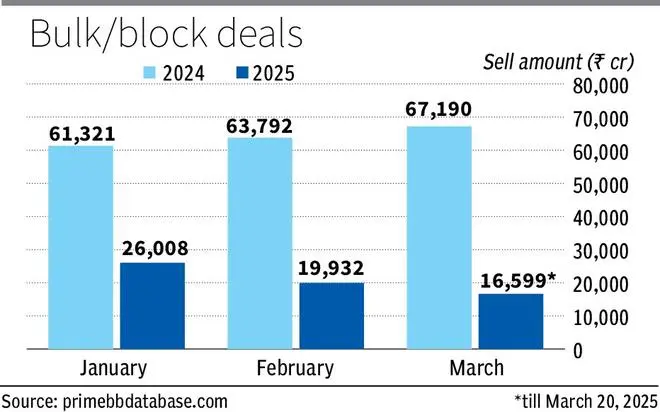

In the first three months of 2025 so far sell-downs worth a mere ₹62,539 crore have been reported compared to ₹1.92 lakh crore in the first quarter of 2024, according to data provided exclusively to businessline by Prime Database.

The steep fall in the prices of stocks has led to fewer sell-downs through the block deal windows, which has been a favoured way for private equity firms, large funds, and promoters to exit or sell stakes in companies and take money off the table.

In each of the first three months of 2024, the value of blocks were over ₹61,000 crore, the data showed.

In 2025, the amounts showed a decelerating trend from January onward. The lower prices and valuation have been deterrents to those planning their exits from their portfolio companies or booking part profits on their investments.

The Nifty 50 has fallen over 14 per cent between September 2024 and February 2025, exchange data shows, which is five months of consecutive losses.

Foreign portfolio investors have been net sellers in the Indian markets for the most part and they posted the fifth consecutive month of outflows last month. Their selling has been across the board, having an effect on all sectors.

Some sectors have seen more selling than others such as financials, fast moving consumer goods, capital goods, autos, and construction materials.

Valuations have fallen quite a bit from their peaks. For instance, the Nifty’s price to earnings ratio is currently at around 20 compared to its longer-term average of 21.1 and 10-year average PE of 24.9, according to Way2Wealth Research.

Smallcap and midcap valuation multiples have also seen a significant erosion from a peak of 46x just a few months bank to 33x now.

Significant deals

Compared to last year, the size of the deals have also fallen.

The largest deal so far this year has been that of Bharti Airtel, in which a promoter entity sold 0.84 per cent stake for ₹8,485 crore. Other deals have been far smaller, less than ₹2,000 crore. The next biggest deal was that of IHC Capital Holding selling 0.73 per cent stake in Adani Enterprises for ₹1,832 crore.