Indian benchmark equity indices extended their rally for the fifth straight session and ended with highest weekly gain in more than 4 years, on bargain hunting and foreign portfolio investors turning net sellers last couple of days. The rupee also ended the week 100 paise higher against the greenback logging the best week in more than two years.

The weekly gains in the stock markets were led by realty stocks, PSU stocks and financials.

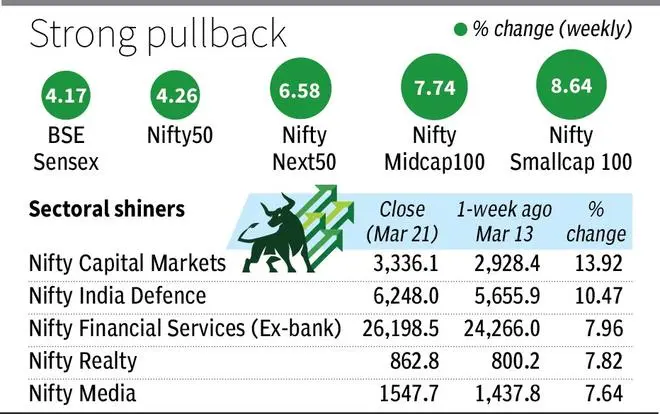

The BSE Sensex closed 0.73 per cent higher at 76,905.51, while the NSE Nifty 50 ended at 23,350.40, up 0.69 per cent. Both the indices rose over 4 per cent during the week.

The broader markets outperformed the benchmarks, with the Nifty Midcap Select rising 1.25 per cent to 11,507.00 and Nifty Smallcap indices gaining over 2 per cent.

“The anticipated reduction in risk-free rates, coupled with the correction in the dollar index, are facilitating fund flows back to EMs. FIIs, whose selling activity has been waning, are becoming net buyers, driven by dovish signals from the US Fed,” said Vinod Nair, Head of Research, Geojit Financial Services.

FPIs bought equities worth ₹7,470.36 crore on Friday, even as DIIs offloaded shared worth ₹3,202.26 crore. On Thursday too, they were buyers.

The Nifty Bank rose 1.06 per cent, while other sectoral gainers included PSU Banks, Media, Oil & Gas, and Healthcare. SBI Life emerged as the top gainer on the NSE, surging 3.43 per cent, followed by NTPC (3.29 per cent), ONGC (2.72 per cent), and Bajaj Finance (2.67 per cent). On the flip side, Trent led the losers, falling 1.60 per cent.

BSE’s total market capitalisation rose significantly to ₹40,924,873.00 crore as of March 20, with the top 10 companies’ market cap climbing to ₹9,175,059.43 crore.

“Investors continued with short covering, which helped Sensex breach the 77k mark in intra-day trades. Also, investors could be squaring off their positions ahead of next week’s monthly F&O expiry,” noted Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

Rupee gains

The Rupee logged its biggest gain on Friday in more than a month, strengthening by almost 40 paise as FPI inflows propelled the domestic equity markets higher.

The Indian unit closed at 85.9725 per USD against its previous close of 86.37. The Rupee saw a gap-up, opening up 9 paise at 86.26 per US Dollar.

Arvind Kanagasabai, Executive Vice-President, Tamilnad Mercantile Bank said, “The Rupee could strengthen further to 85.84/85 levels, then again start weakening. It will move up and down hereafter, instead of moving only one-way (depreciating) like what happened earlier. Over a period of one year, the Rupee should go back to 83.50 to 84 levels as there could be a rally in the Indian markets”.