A handful of entities have raised money from social stock exchanges (SSEs) since 2023.

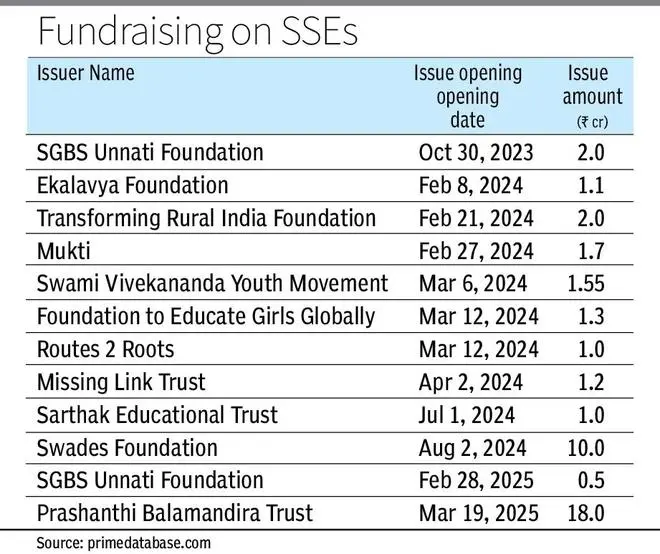

Over a 100 Not-for-Profit (NPO) organisations have registered so far with SSEs, but only 11 entities have raised money to the tune of ₹41 crore, data showed. Seven entities had listed in FY24, which dipped to five this fiscal.

“SSEs are a phenomenal platform to build trust and credibility for NGOs. While there have been ample registrations, listings have been few given the disclosure requirements and the need to define the social impact clearly. The regulator also needs to incentivise and create the right ecosystem for donors,” said Ramesh Swamy, Director, SGBS Unnati Foundation.

SEBI recently came up with proposals to cut minimum application size for issuances on social stock exchanges from ₹10,000 to ₹1,000 or ₹5,000. It also plans to expand the list of eligible activities to be identified as a social enterprise to include welfare of disadvantaged children, women, destitute, elderly and the disabled; vocational skills and promotion and education of art, culture and heritage.

SEBI has proposed that NPOs be permitted to register with SSEs for two years without raising funds given that many do not graduate to listing or renew the registration due to the cost of annual reporting including the social impact assessment of significant programmes.

A key challenge

A key challenge is to provide greater visibility to the track record and impact being created by social enterprises, said experts.

“No retail investor will know how and where to invest in the funds until they are provided the information on these opportunities. A proper distribution channel mechanism should be promoted to bring in these investors. Other measures could be to allow Corporate Social Responsibility through SSEs as well as allow foreign funds with clear due diligence and reporting,” said Akshaya Bhansali, Partner, Mindspright Legal.

Inclusivity

SEBI’s proposal to expand the list of eligible legal structures for NPOs and allow them to register with the SSE for up to two years without fundraising, offers significant benefits, said Bhansali. It provides greater inclusivity, she said, allowing more organizations to access the platform, while also giving them time to adapt to the SSE’s processes.

“What is required is that the exchanges and the listed NGOs make use of social media and other platforms to outreach their presence,” Bhansali added.

SSEs were first mooted in the FY20 Budget with an aim to list social enterprises and voluntary organisations.