Market prices have plunged for major pulses in the current rabi marketing season. Commodity trade experts and policy advocates caution that the government must curb the import of pulses to protect domestic producers and value chain actors.

The oilseeds sector is no exception to this phenomenon. For example, soyabeans, or golden beans, are a vital oilseed crop. However, India’s share of soyabean production in the global pie is a meagre 3 per cent, and about 81 per cent of world production comes from Brazil, the US, and Argentina. India imports soyabean oil to meet more than 50 per cent of annual consumption.

Higher import of soyabean oil may be attributed to India’s lack of ‘competitive edge’ or ‘factor endowment’ in soyabean production, processing, and trade, which contradicts the quest for self-reliance in oilseeds in general and soyabean in particular.

In her Budget 2024–25 speech, the Finance Minister emphasised “atmanirbharta” in oilseeds production, storage, and marketing.

So, what strategies should the government take to achieve this? To answer this, a deep dive into the oilseeds economy and trade is necessary, with soyabeans as a point of discussion.

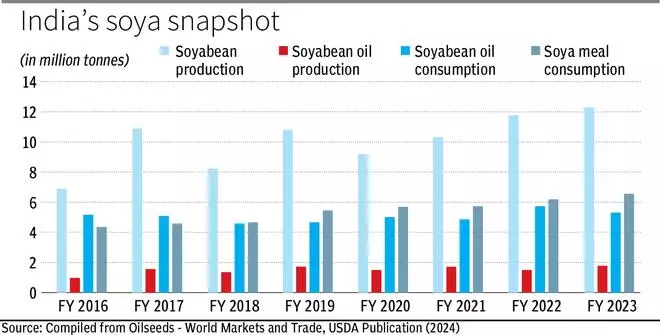

In India, soyabean production witnessed a CAGR of 5 per cent between 2015-16 and 2022-23, showing a cyclical trend (see Chart).

Soya oil production has stagnated at 1.5-2 million tonnes (mt) with a CAGR of 8 per cent between 2015-16 and 2022-23. China has been the leading producer of soyabean oil globally. As for soya oil consumption, India reported 5.5 mt with a CAGR of 9 per cent from 2015-16 until 2022-23. Nepal and the US have met much of the consumption demand.

The demand from livestock and poultry feed industry has had a bearing on soya meal production and consumption. Soya meal consumption has increased since 2018-19 with a CAGR of 5 per cent. The European Union is the largest importer of soya meal, at more than 16 mt, while Vietnam imported around 5.95 mt in 2022-23.

A few key factors are impacting India’s soyabean economy and trade. First, the acreage under, and productivity of, soyabean crop have been declining; post-harvest losses are 12-15 per cent.

Second, a lack of price risk management tools dissuade small oil processing units from investing in crushing activity.

Third, the Covid-19 pandemic, exacerbated by the Russia-Ukraine war, affected the soyabean supply chain, which pushed global edible oil prices 140 per cent since late 2020. Since India is a net importer, higher bean prices translate to increased profits for traders, not Indian farmers, except some large ones.

Fourth, the demand for complying with sustainability standards voluntarily has pushed major soyabean processing and trading firms to make sustainable sourcing commitments.

These firms have contracted large farmers in major production centres for sourcing, creating supply shocks in the domestic market. Meanwhile, as traders and large farmers gain, small farmers are left out as they do not have economies of scale.

Policy suggestions

The government must incentivise farmers to expand the acreage under oilseeds with climate-resilient, short-duration varieties and push technology adoption in post-harvest loss management at the farm-gate, processing, and trade points. The minimum support prices for soyabean procurement should account for climate risks attributed to rainfall variability and localised climate risks.

A surplus or profit should be realised from crushing activity by utilising optimal plant capacity. The government can fix a markup price that adequately covers procurement and crushing costs.

Since the commodity derivatives market is instrumental in price discovery and risk management, the government must revoke the ban on futures trading in soyabean and its derivatives. Crush spread as a futures instrument can be introduced to help processors manage their exposure to soyabean and soya oil and soya meal.

Fourth, as a prudent response to Trump’s reciprocal tariffs, India can reduce its import volume from the US and deepen its bilateral trade with Brazil and Argentina for soyabean procurement and the EU and Vietnam for soyameal exports.

The writer is an Associate Professor, Agribusiness Management Area, at IIM Lucknow. Views are personal