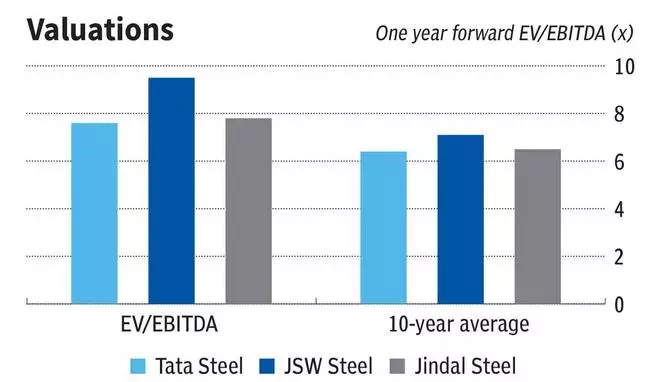

Steel realisations, impacted by weak demand, Chinese imports and higher capacities, have continued to decline. The profitability has been helped by lower raw material and energy costs. Though the expansion is starting to inflate the debt metrics, it is still at a manageable level. Further, US tariffs on steel realisations can impact the domestic steel industry, especially with valuations above past-decade’s average.

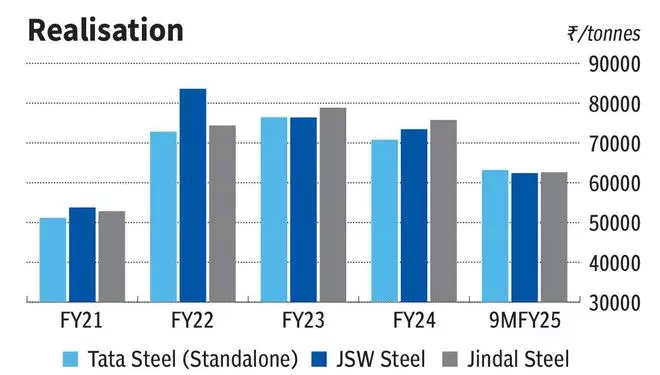

Steel realisations have declined by an average 15 per cent in the last year. Refracted trade flows from US tariff’s could exacerbate the problem with Chinese imports.

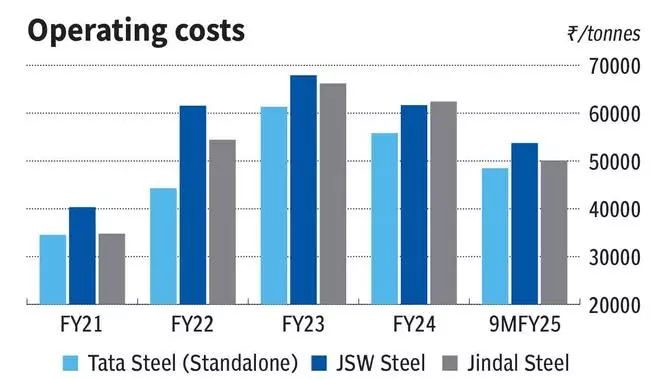

Coal and energy costs have declined in the last year providing relief to manufacturers. Weak global economy may sustain the lower price for energy.

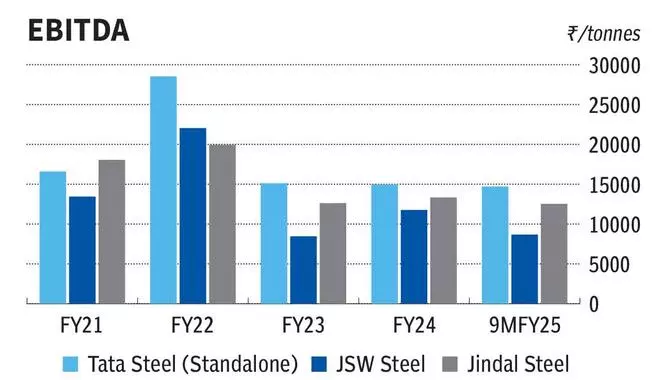

An improvement in realisations will be critical to improved profitability, which continues to be at the lower end despite an increase in operating leverage from expanded capacities and lower cost of energy.

While companies were conservative on debt metrics in March 2022, there has been increased appetite for debt, driven by the ongoing capacity expansion.

The stocks are trading at a premium owing to capacity expansion, strong domestic demand and expected improvement in profitability.