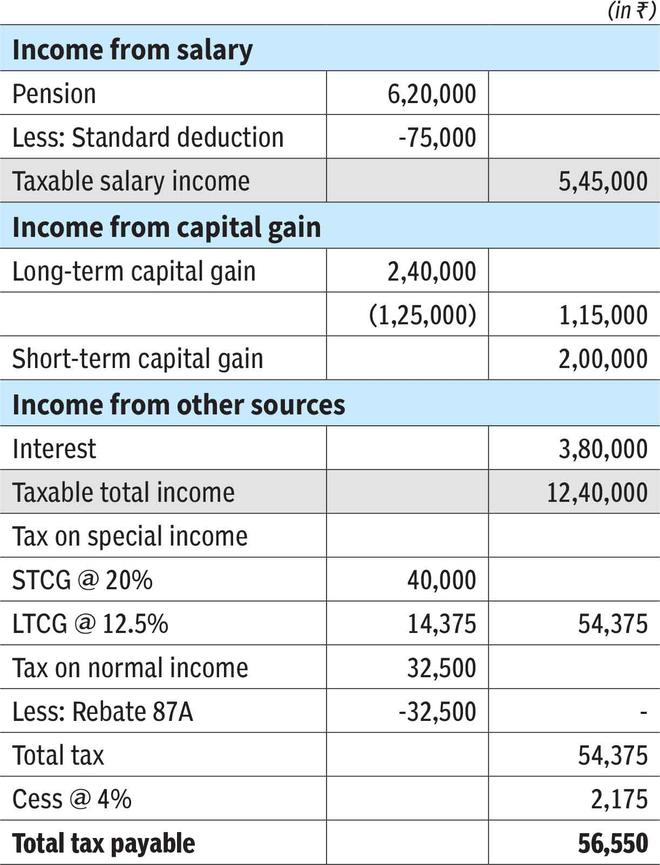

I am a little confused about the calculations of income tax in view of the tax proposals under the new regime. I am also a senior citizen. For FY26, I will be having the following incomes: Pension amount – ₹6.2 lakh; Interest income – ₹3.8 lakh; (-) Standard deduction – ₹75,000; long-term capital gain (LTCG) – ₹2.4 lakh; short-term capital gain (STCG) – ₹2 lakh.

Kindly calculate my tax liability.

Brij Lal Dhiman

Based on the details provided, the tax liability is calculated as below. We have assumed that the LTCG/STCG is covered under section 112A / 111A respectively and the sale is expected to happen in FY26:

The writer is Partner, Deloitte India

Send your queries to taxtalk@thehindu.co.in

Published on April 5, 2025