What is the outlook for GAIL (India)? Can I buy the stock now?

Preethi, Bengaluru

GAIL (India) (₹176.75): The stock is in a downtrend since late September last year. The recent rise from the low around ₹151 made in early March this year has given some breather for the stock. Resistance is around ₹190. A strong rise above this hurdle is needed to confirm the trend reversal. Such a break can take GAIL (India) share price up to ₹250 again.

Failure to breach ₹190 can keep the stock in a range of ₹150-190 for some time. A break below ₹150 can drag the price down to ₹130. A fall beyond ₹130 is less likely. From a long-term perspective you can buy the stock at ₹160 and accumulate at ₹140. Keep the stop-loss at ₹110. Trail the stop-loss up to ₹185 when the price goes up to ₹205. Move the stop-loss up to ₹215 when the price touches ₹230. Exit the stock at ₹250.

I have purchased Sterlite Technologies Ltd at ₹148. Please advise whether to exit or buy more at current levels?

Madhusudana Rao

Sterlite Technologies (₹80.52): The stock has been in a strong downtrend since January 2022. Recently it has declined below a key support level of ₹95. That has opened the doors for Sterlite Technologies share price to see ₹70 on the downside. In case the stock declines below ₹70, the price can tumble to ₹38. Ideally, the stock has to rise above ₹130 to indicate a trend reversal and become bullish. That looks unlikely. Even if it is going to happen, it may take a lot of time.

So, exit the stock and accept the loss. You may consider reinvesting the sale proceeds in GAIL (India) explained in the previous query and follow the same strategy. We always insist on having a proper stop-loss at the time of entering a position. That will help you to minimise the loss and develop a discipline.

What is the outlook for Sandur Manganese & Iron Ores? Can I buy the stock now?

Nagaraj, Nagercoil

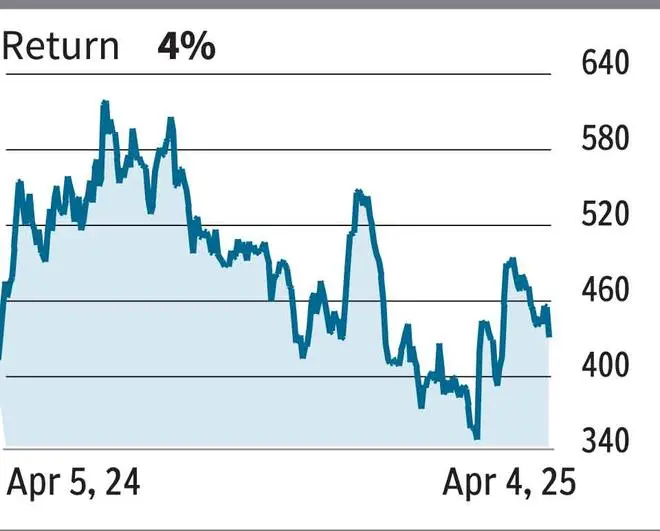

Sandur Manganese & Iron Ores (₹424.40): The long-term uptrend in the stock seems to have paused. The stock has been oscillating in a wide range of ₹330-₹635 for more than a year. The stock has to sustain above the crucial support level of ₹330 to keep the uptrend intact. A break below it can drag the share price down to ₹240-220 in the coming months.

On the other hand, a strong rise above ₹500 is needed to indicate that the broader uptrend has resumed. If that happens, then the next leg of rally can take the stock up to ₹900-950 over the long term. So, buy only above ₹500. Keep the stop-loss at ₹320. Trail the stop-loss up to ₹560 as soon as the stock goes up to ₹650. Move the stop-loss further up to ₹800 when the price touches ₹880. Exit at ₹920.

What is the technical outlook for Balkrishna Industries. I would like to buy this stock.

Ashish

Balkrishna Industries (₹2,396.85): The stock is in a correction phase within the broad uptrend. There is room on the downside for further fall towards ₹2,300-2,200. Thereafter a reversal is possible. But if the price declines below ₹2,200, the downside can extend even to ₹1,950. Key resistance is at ₹2,900. The stock has to breach this hurdle to confirm the resumption of the uptrend.

So, even if the stock reverses higher from ₹2,300-2,300, it is important to see if the price is rising above ₹2,900 or not. Only then the doors will open for a rise to ₹3,500 and higher levels. So, considering the chances to fall more, we would suggest to stay out of this stock now. As mentioned above, this stock will become a convincing buy only after it moves above ₹2,900. So, you may have to wait until then.

Send your questions to techtrail@thehindu.co.in

Published on April 5, 2025