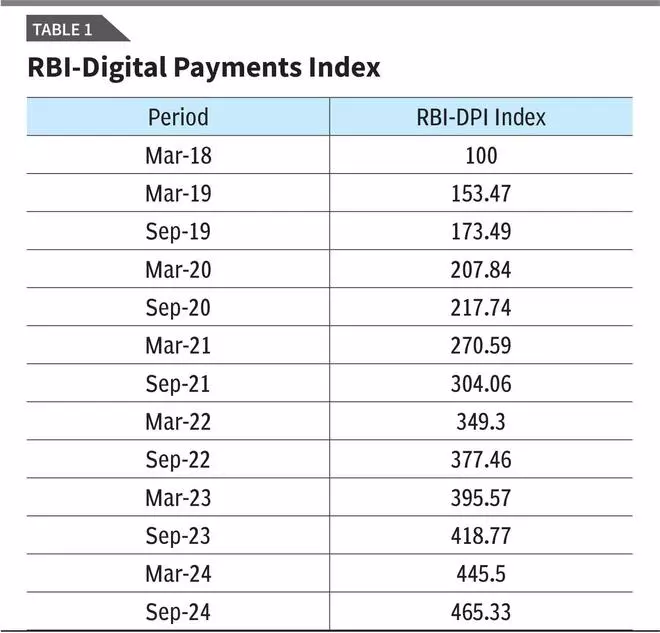

India’s journey towards a digital economy has been nothing short of transformative. With initiatives like Digital India and the Unified Payments Interface (UPI), the nation has witnessed an unprecedented surge in online transactions. India’s digital payment ecosystem has expanded phenomenally, as evidenced by the RBI-Digital Payments Index (RBI-DPI), which surged from a base value of 100 in March 2018 to 465.33 in September 2024 (see Table 1).

This growth reflects advancements in payment infrastructure and performance. However, alongside this remarkable progress lies a steep increase in digital payment fraud. The first half of FY2024-25 alone recorded a staggering 18,461 fraud cases, with a total financial impact of ₹21,367 crore — a 27 per cent year-on-year increase. Notably, domestic payment frauds spiked by 70.64 per cent, reaching ₹2,604 crore by March 2024.

Cybercrimes and types of fraud

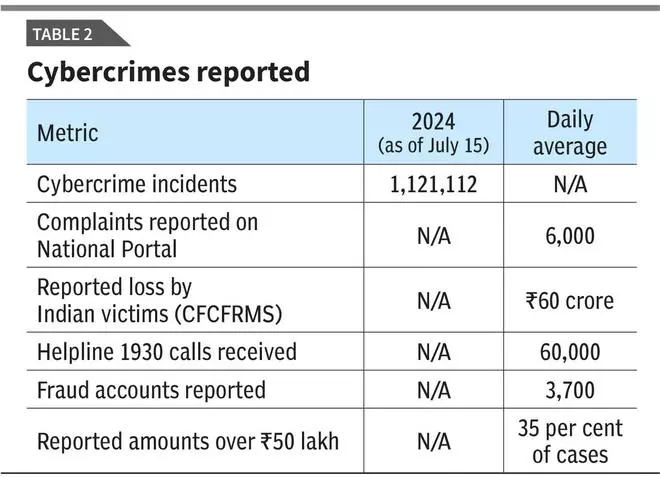

The data on cybercrime reveals an alarming trend in the rising frequency and severity of online fraud in India. By mid-2024, a staggering 1,121,112 cybercrime incidents had been reported (see Table 2).

The rise in fraud cases is further reflected in the reported financial losses, with Indian victims reporting a loss of ₹60 crore in 2024 alone. In addition, the helpline 1930 received 60,000 calls in the same year, indicating the surge in victims seeking assistance. A concerning 35 per cent of fraud cases in 2024 involved amounts exceeding ₹50 lakh, highlighting the scale of high-value cyber frauds.

A breakdown of the types of cyber frauds reveals the modus operandi that fraudsters commonly employ (see Table 3).

The largest share of frauds in 2023 was attributed to customer care, refund, and KYC scams, accounting for 40 per cent, followed by investment and task-based frauds, which also made up 40 per cent. Other prevalent types included sextortion (24 per cent), illegal loan apps (23 per cent), and illegal gaming/crypto scams (21 per cent). These frauds are becoming increasingly sophisticated, targeting vulnerable individuals through various means, such as remote access, fake investment opportunities, and even exploiting online relationships.

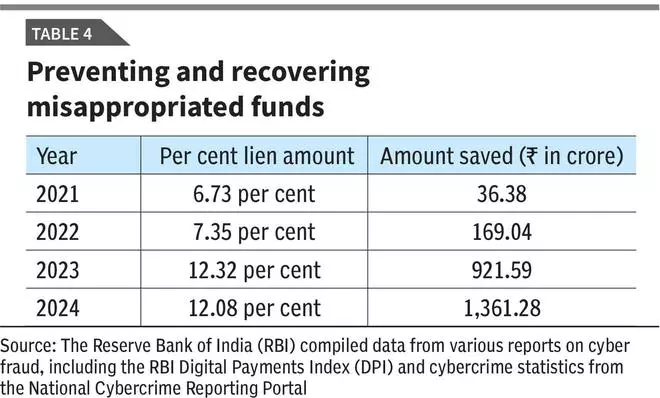

The CFCFRMS (Cyber Fraud Control and Recovery Management System) data shows the effectiveness of recovery efforts in preventing and recovering misappropriated funds (see Table 4).

From ₹36.38 crore saved in 2021 to ₹1,361.28 crore in 2024, the amount recovered through the system has increased significantly. The percentage of lien amounts (money withheld for fraud prevention) has remained relatively stable, ranging from 6.73 per cent in 2021 to 12.32 per cent in 2023, with a slight decrease in 2024. This data reflects both the growing impact of cyber fraud and the success of initiatives aimed at mitigating losses.

Learning from global best practices

Several countries offer valuable insights for combating digital fraud. Singapore has implemented a robust national digital identity framework, ensuring secure online authentication and reduced identity theft. The UK’s ‘Take Five’ campaign emphasises critical thinking, educating individuals to resist fraudulent requests for personal or financial information. Likewise, Australia’s ‘No More Scams’ campaign combines efforts from the government, law enforcement, and the private sector to raise awareness, enhance security, and disrupt scams.

In the US, the Consumer Financial Protection Bureau (CFPB) empowers consumers through education, enforcement, and tools to avoid fraud while penalising unfair practices. South Korea’s Financial Security Institute (FSI) proactively monitors and mitigates cyber threats in the financial sector. Canada’s Anti-Fraud Centre serves as a centralised hub for fraud reporting and prevention, enabling effective collaboration among law enforcement agencies. The European Union’s GDPR enforces stringent data protection measures, increasing accountability and transparency to reduce data breaches. By studying and adapting these global best practices, India can strengthen its fight against digital fraud and create a secure online environment for its citizens.

Countermeasures and way forward

The rise of digital fraud in India is a pressing concern that demands immediate and coordinated action. Addressing this menace requires a multi-pronged approach involving all stakeholders. Banks and financial institutions must prioritise strengthening their security infrastructure, implementing robust fraud detection systems, and adopting multi-factor authentication to enhance customer account protection. Simultaneously, educating users about digital security best practices, common fraud tactics, and safe online behaviour is essential.

Public awareness campaigns, workshops, and educational resources can play a pivotal role in empowering users to protect themselves. Enhanced collaboration and information sharing among banks, financial institutions, and law enforcement agencies are critical for timely detection and prevention of fraud.

A strong regulatory framework that adapts to the evolving nature of digital fraud is crucial, including clear guidelines for data protection, cybersecurity, and fraud prevention, coupled with stringent penalties for offenders. Leveraging advanced technologies like artificial intelligence (AI) and machine learning (ML) can help identify and flag suspicious transactions in real-time, enabling proactive fraud prevention.

In line with these efforts, the RBI Governor’s call for collaboration emphasises the importance of robust security measures, user awareness, and global best practices. The Consumer Education and Protection Department has outlined key goals for April 2024 to March 2025 under RBI’s medium-term strategy (Utkarsh 2.0). These goals include enhancing the complaint management system, developing a consumer protection assessment matrix for Regulated Entities (REs), strengthening grievance redress mechanisms, conducting surveys to understand the low level of complaints, and rolling out an improved Nationwide Intensive Awareness Programme based on feedback from REs and Ombudsman offices (ORBIOs). A collective effort is crucial to build a resilient and trusted digital ecosystem, ensuring security, trust, and protection for all users.

Williams is the Head of India at Sernova Financial, Valiachi is an Assistant Professor in Sathyabama Institute of Science and Technology and Nagaraj is a Research Scholar at Alagappa University