When Madhabi Buch, the previous chairperson of SEBI, stated that REITs, InvITs, and municipal bonds could surpass the equity and debt markets over a decade, it raised eyebrows. While municipal bonds are gaining attention, municipal loans remain the backbone of urban financing in India. This article argues that strengthening municipal loan markets is essential for sustainable urban infrastructure and financial inclusion.

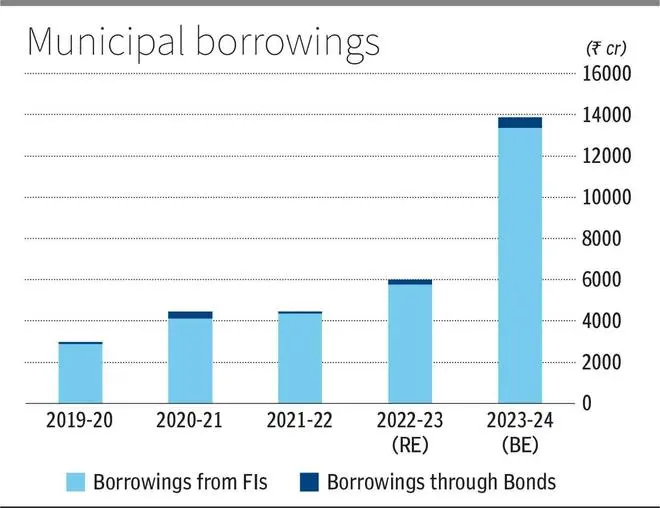

According to the RBI report on municipal finances, borrowings by municipal corporations from financial institutions (secured and unsecured) increased from ₹2,886 crore in 2019-20 to ₹13,364 crore in 2023-24 (BE). Over the same period, municipal bonds grew from just ₹100 crore to ₹500 crore.

Despite the policy focus on municipal bonds, these figures highlight that municipal loans remain the preferred and necessary financing route for cities. To effectively meet the infrastructure and operational demands of municipalities, strengthening the municipal loan ecosystem is imperative.

Greater accessibility and flexibility

Municipal loans provide several advantages over municipal bonds:

Ease of access: Unlike municipal bonds, which require extensive regulatory compliance and high credit ratings, loans involve fewer procedural hurdles.

Lower transaction costs: No underwriting fees or bond issuance costs make loans a more cost-effective option for municipalities.

Flexible repayment schedules: Loans can be tailored to the cash flow realities of municipalities, making them more suitable for small borrowing needs.

Inclusive financing: Only 34 out of 468 urban local bodies assessed under the AMRUT programme received an A- rating or above, making them eligible for bond issuance. In contrast, municipal loans remain a viable option for a broader range of cities.

Leveraging technology

While municipal loans have been the traditional source of financing, there is significant potential for innovation in this sector. Munify, India’s first national municipal database, is building an aggregator platform for municipal loan markets. Similar platforms in the MSME and retail loan segments have brought greater transparency and standardisation to lending processes. A structured municipal loan marketplace can enhance efficiency, widen lender participation, and ensure better financial discipline among borrowing cities.

State-level borrowing trends

As per RBI data, per capita borrowings from financial institutions are highest for municipal corporations in Odisha, followed by Telangana, Tamil Nadu, and Maharashtra. However, bond market participation is dominated by Gujarat, Madhya Pradesh, Telangana, Maharashtra, and Uttar Pradesh. Cities like Hyderabad have successfully used a mix of bonds and bank loans for infrastructure projects — Greater Hyderabad Municipal Corporation financed ₹495 crore through bonds and ₹5,895 crore through bank borrowings.

Tamil Nadu municipalities, which were once active in bond markets through pooled sanitation funds, have now stayed away due to high revenue deficits. This underscores the need for a robust municipal loan market, as bond financing is often inaccessible to financially weaker municipalities.

Unlike municipal bonds, which have been largely restricted to water supply, sanitation, and storm-water drainage projects, municipal loans finance a broader range of projects. For instance, Bhubaneswar Municipal Corporation has borrowed funds for an interstate bus terminal, municipal market, and slaughterhouse. Expanding loan access can facilitate city development across multiple sectors.

Currently, a significant portion of municipal loans come from State-controlled financial institutions such as the Tamil Nadu Urban Development Fund and HUDCO, which require State government guarantees. Encouraging private sector participation in municipal lending can further expand access to capital and reduce dependency on government-backed funding.

A call for policy support

The Central Government and the RBI must take active steps to modernise and strengthen the municipal loan market alongside municipal bonds. Key recommendations include: standardising loan documentation and processes to enhance transparency and credibility; creating credit enhancement mechanisms to encourage private lending; developing digital marketplaces to improve accessibility and streamline loan transactions; and providing policy incentives to municipalities opting for structured loans rather than relying solely on government-backed borrowing.

While municipal bonds contribute to financial transparency and market discipline, they remain limited to high-credit-quality issuers. Municipal loans, on the other hand, offer more inclusive financing opportunities for cities with varied credit profiles. Strengthening the municipal loan ecosystem through policy support, technology-driven platforms, and greater private sector participation is crucial for addressing India’s growing urban infrastructure needs.

By prioritising both municipal bonds and loans, India can develop a well-rounded municipal finance system that ensures sustainable and inclusive urban growth.

The writer is a senior credit professional and the founder of Munify Datatech Private Ltd