Apparel retail has been one of the toughest industries to be in, in the recent past. Ask Aditya Birla Fashion and Retail (ABFRL). Though it managed to grow its revenue at a CAGR of 31 per cent during FY22-24, it has been churning out net losses since FY20.

E-commerce disrupted the space, and the traditional brick-and-mortar players have been fighting to even hold their market share alongside a macro trend of formalisation of the economy, with organised players winning over the unorganised. Amidst all this noise, one entity managed to thrive and gain, particularly in the last five years — Trent, a Tata Enterprise.

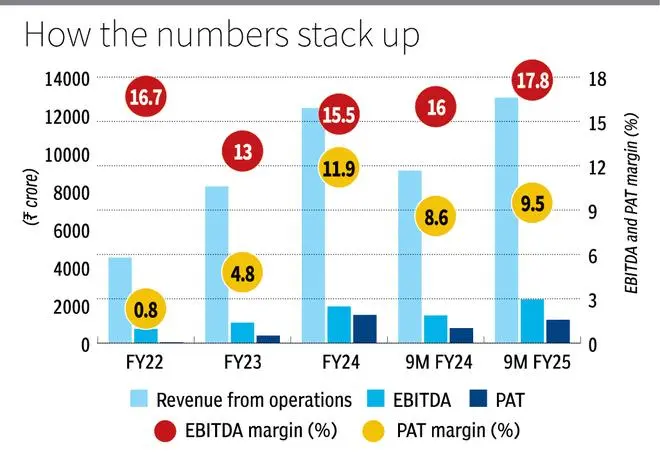

Trent’s revenue/ EBITDA/ PAT grew at a strong CAGR of 37 per cent/ 25 per cent/ 105 per cent during FY20-24 and ignoring the Covid blip, growth during FY22-24 has been at a much faster 66 per cent/ 53 per cent/ 342 per cent respectively.

Operating predominantly in the fashion retail space, it has been one of the largest wealth creators in the post-Covid era. The stock returned a staggering 1,850 per cent from its Covid-lows to its peak in October 2024. But what followed since was a 40 per cent correction. Though the broader market correction coincided with the stock’s fall from the peak, the slowing growth and an inexplicably high three-digit PE multiple were the key value detractors for the stock.

Trading at 77.5 times its FY26 earnings, though below the five-year average one-year forward PE multiple of 164.5 times, the stock looks priced to perfection here. For 9M FY25, revenue/ EBITDA/ PAT have grown year on year at a reasonably strong 42 per cent / 58 per cent / 57 per cent respectively. For comparison, Reliance Retail saw its revenue/ EBITDA/ PAT grow at a nominal 3 per cent / 7 per cent / 7 per cent respectively during the same period. But considering the drop in like-for-like (LFL) growth in Q3 for fashion concepts, the scales look balanced here.

Existing investors can consider holding on to the stock while not making fresh buys. The pull and push factors making the risk-reward balanced, for now, are explained below.

House of concepts

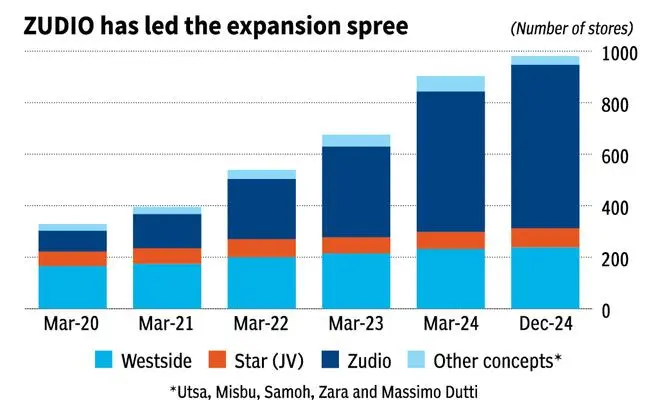

Trent houses a good bunch of ‘concepts’, as the company terms its segments. While Westside and Zudio are its mainstay profit centres now, other fashion concepts include Utsa, Misbu and Samoh. Notably, all merchandise sold through the above concepts are private labels (own brands).

With a significant presence across the value chain — from sourcing raw materials and collaborating with contract manufacturers to design, inventory management and B2C retail – Trent, by retaining significant operations in-house, protects its profit margins.

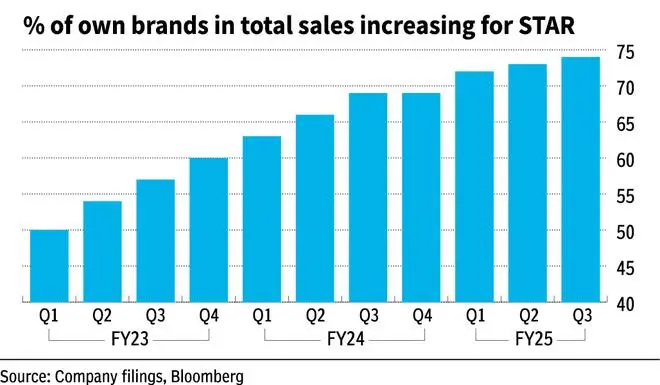

Star, a JV with British retail major Tesco plc, is another concept of Trent which recently hit profitability at the operating level (while still making losses at net level as of FY24). Operating hypermarkets, the share of private label products sold by Star has been consistently increasing and stood at 74 per cent for Q3 FY25 against 69 per cent in Q3 FY24.

The company also has a JV with Inditex (the Spanish fashion retailer) to operate Zara (affordable fast fashion) and Massimo Dutti (aspirational fashion) stores in India. It also has a JV with MAS Amity to distribute its innerwear, active wear and athleisure offerings.

At least 95 per cent of the sales comes from offline channels for the company despite a 45 per cent year-on-year increase in online sales observed during 9M FY25. And online presence is only through Westside.com, Tata Cliq and Tata Neu. The management cited deterring logistics costs for a minimum online presence and notably, Zudio has no online presence and its sales are entirely from its offline stores.

The ZUDIO factor

Trent, typically, incubates new concepts. And once the concepts have been tuned, it goes on to expand the retail presence of such concepts, kicking off a new growth engine. And Zudio, a concept conceived in 2016, went through a similar cycle.

While the total store count of all concepts operated by Trent almost tripled, growing at a CAGR of around 29 per cent during FY20-24, Zudio’s store count multiplied at a much faster CAGR of 62 per cent during the same period. And it is during this phase that Trent’s financials saw strong growth both in revenue and profitability.

Trent cracked the fast fashion (also called value fashion) segment with Zudio. With no SKUs priced above ₹999, Zudio found a tremendous offtake. With other organised fashion retail players being late to the party, Zudio’s real competition was the unorganised apparel stores, which they beat through internal efficiencies.

The slowdown

As every high-growth phase normalises, the average growth in Q2 and Q3 of FY25 slowed down to 37 per cent across revenue and EBITDA, while PAT grew 40 per cent. And importantly, LFL growth for the mainstay fashion segment fell from double-digit (until Q2 FY25) to high single-digit in Q3, while it fell from around 25-30 per cent for Star to 10 per cent in Q3.

The slowdown, at this point, could be attributed more to the diminishing low base effect, while actual growth still seems reasonably strong. EBITDA margins have rebounded strongly and stood at 18 per cent for 9M FY25 improving 200 bps y-o-y. This is attributed to operating leverage kicking in from existing stores.

Though a growth rate of around 35-40 per cent is by no means low, Trent’s huge valuation premium in October 2024 needed a trigger to correct, and the deceleration in growth gave the excuse. While the company’s strategy to optimize existing store portfolio by upgrading and consolidating existing stores, as appropriate, might be a short-term pain, if any, it is positive for the medium-long term.

The company’s strategy to have separate outlets for beauty products through Zudio Beauty and possible foray into lab grown diamonds remain key monitorables.

Comeback of SHEIN

In June 2020, the government of India banned 59 applications on all internet-enabled devices in India, citing security concerns. And Shein, a Chinese online fast-fashion retailer, was one of them. Now, after around 56 months, a strategic collaboration with Reliance Retail and shifting its base off China (to Singapore in 2022) has paved way for Shein’s comeback into Indian markets.

Why is Shein, now, the biggest talk-point? A disruptor in the global fast-fashion space then, Shein is now a market leader in the category displacing Zara and H&M, and even a pioneer in a new derived category — ultra-fast fashion.

The fight could well be taken to Zudio now, with Shein matching Trent’s strengths, almost to the dot, and Reliance pitching in with its sheer financial might, setting the stage for action.

But its online-only presence puts it in the same bracket as Myntra and AJIO, and FY26 will have to be keenly watched to understand the impact on Trent’s growth.

Valuation parallel

Trent’s market-cap currently stands at around ₹1.8 lakh crore, parallel to that of its most comparable competitor Zara’s in January 2010.

Comparing the both, for that period ended January 31, 2010, Zara had clocked in a topline of around ₹74,820 crore, whereas Trent’s trailing 12-month revenue as of Q3 FY25 stands at ₹16,215 crore, a little above just one-fifth of Zara’s. And interestingly, Zara enjoyed a higher operating profit margin of around 21-22 per cent during that phase (and currently around 27-28 per cent) as against Trent’s current 13-15 per cent. However, revenue growth of Trent has been rapid in the past five years, while Zara, on the other hand, has been growing consistently, albeit at a slower pace, at a CAGR of around 15 per cent.

The pace of growth of Trent definitely calls for a premium. But, at current point, such premium looks appropriate leaving limited room for upside.