Markets have been spiralling for a few months, thanks to the recent earnings slowdown, long-pending valuation concerns and tariff threats, among other reasons. With sustained volatility and continuing sell-off by FPIs, panic has been set loose. In this context, many investors are weighing in whether to exit now and secure the gains accumulated over the past five years, or in some cases, cut their losses and move on.

But what if we tell you, there is a flock of investors struggling to even get an opportunity to exit, let alone the profit and loss?

A lot of first-time investors jumped into the Indian equity markets in the 1990s, the early stage of India’s economic boom. It is highly likely that those investments have grown significantly over time and, in the best-case scenario, could even fund one’s retirement.

But the problem is that being investments made decades ago, they would have been in the form of physical share certificates and hence, possibly misplaced or forgotten. Left unattended, a good chunk of these unclaimed investments is transferred to the Investor Education and Protection Fund (IEPF) every passing year.

The value apart, these investments represent the hard toil and labour of their long-gone spouses or predecessors. While there would be a few lakhs of people out there fighting it out to reclaim their unclaimed assets, another bunch might even be blissfully unaware of its inherited assets with the IEPF.

IEPF does not provide the market value of listed shares it holds. Based on information compiled from disclosures of all listed entities and analysed by Fee-Only Investment Advisors LLP, a SEBI-registered investment advisor, as of April 2024, IEPF had a staggering ₹71,333-crore worth of listed equities and ₹5,700 crore of unclaimed dividends. And this amount does not even include the value of unlisted equities and other products like debentures.

Are you one of those struggling to reclaim your unclaimed shares or know someone who is? Let’s understand the what, why and how of the drill pertaining to transmission of shares.

The push to dematerialisation

With dematerialising physical shares made compulsory for most transactions since April 2019, thanks to SEBI, transmission (the process of transferring shares from the deceased to legal heirs) and transposition (the process of changing the order of names in joint holding) are the only exceptions.

And it is in this transmission process, where a lot of pain-points have been voiced out.

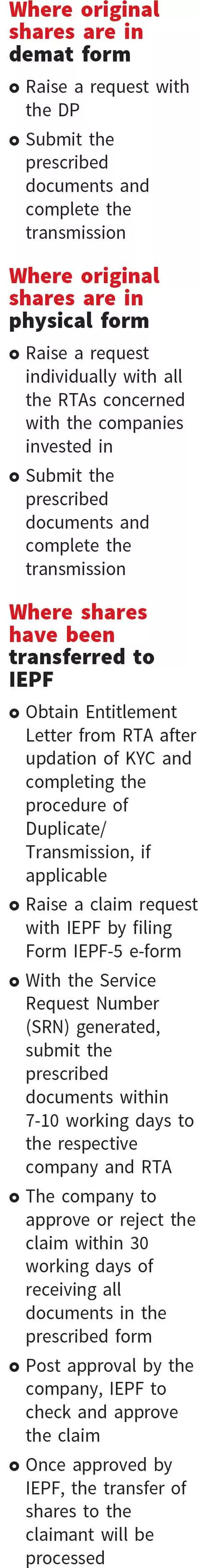

If the transmission is pertaining to shares already in dematerialised (demat) form, the process is relatively easier. The surviving legal heir has to apply to the depository participant (DP), commonly the stockbroker, and claim such holdings of the deceased. In this case, DP remains the single point of contact and on submission of the prescribed documents, the shares get transferred to the inheritor’s demat account.

Tweaks by SEBI in 2023 have mandated listed companies to issue securities in demat form only while processing all requests including transmission and transposition, even if the original shares were in physical form.

But if the transmission is pertaining to shares in physical state, the process is considerably time-consuming, among other things.

The ideal drill

As per SEBI regulations, it is compulsory for all listed entities to engage SEBI-registered Registrar and Transfer Agents (RTA) or have an in-house department for handling share transfers, dividend payout, dematerialisation and other allied activities. And listed companies often prefer the first route.

So, in this case of transmission of physical shares, one will have to reach out to the concerned RTA of the company, to claim the shares inherited.

The RTA must guide the investor with the list of documents required to be submitted for the process of transmission. With the prescribed documents standardised by SEBI with effect from October 2021, the erstwhile trouble in complying with varied processes and requirements of different RTAs and companies has been done away with.

After all these documents are verified and approved by the RTA, the shares would be transferred in the name of the inheritor. Post this approval, RTA gives a Letter of Confirmation which, when submitted with the DP, gets the shares transferred to the demat account of the inheritor. Simple right? No, it is so only in theory. The real-life experience of Akash (name changed), a project management professional, is different.

Practical difficulties

In the case of Akash, among the companies his late father had invested in, he was able to elicit response promptly from L&T. He found the contact information from the annual report and the mail to the CFO was met with a prompt reply, forwarding the query to its RTA, KFin Technologies, within hours. And with just a correspondence document to validate the shareholding and original share certificates lost, the RTA guided him to raise a police complaint, based on whose acknowledgement duplicate shares would be issued post verification, which is part of the process.

However, his experience with a listed subsidiary of a German MNC has been turbulent. He first got to know that his father’s shares were to be transferred to IEPF, from a cold call from a consultant, saying they can help with the transmission process for a fee. Once he got to know this, he decided to prioritise recovering this investment, by himself, given the hard stop.

But he has had a tiring experience so far. The response was lacklustre to begin with, despite multiple escalations to the senior management. The first meaningful reply, asking for a set of documents to advise further, came after around four weeks of follow-up. The experience was difficult even for a financially-literate professional like him, with the initial responses not being investor-friendly.

Also, the request for dematerialising his mother’s (alive) shares in the same company was sent back citing concerns of signature not matching (though the differences were insignificant, and counter signed by the bank officials) and for other trivial reasons like absence of a round seal of the bank despite the presence of a square seal and counter signed with details of the bank employee.

Transfer to IEPF

All shares in respect of which dividend has not been paid or claimed (earlier — cheques not encashed or returned due to change in address not updated with company; now — bank account linked with demat account becoming inoperative) for seven consecutive years or more, per section 124 of the Companies Act, 2013, shall be transferred by the respective company to the IEPF, managed by the Ministry of Corporate Aairs, along with the details of the owners. In case the shares or funds are transferred to IEPF, subsequent claims are to be routed through the IEPF and the matter falls outside SEBI’s regulatory framework.

Currently, the government has set up a search portal ( open to the public, to fetch details of unclaimed shares with IEPF, based on the information collected from the companies. While the earlier version of the search portal needed details of their unclaimed assets, when people didn’t know if they had any in the first place, the recent updated version provides a relatively-clean and transparent database which could be searched with either a combination of name and folio number or name and father’s name. While the portal is still a work in progress and suffers from occasional shutdowns, it is a step in the right direction.

Recovery consultants

There are numerous consultants in the market who specialise in recovery of these unclaimed investments. Share Samadhanis one such, with a track record of helping investors make successful claims of their unclaimed assets, not just limited to listed shares.

Claiming it back from IEPF could be the most time-consuming, says Shrey Ghosal, Director and Head of Operations at Share Samadhan, adding that the average time taken for IEPF to approve or reject a claim is currently in the range of six months to three years, which remains the biggest pain-point. Ghosal also states that while a few companies and RTAs are prompt and proactive in their responses, some require constant push and even escalation.

A key reason for companies and the RTAs to prefer transferring the unclaimed shares to the IEPF than resolve the claims themselves might be to avoid the trouble of future correspondence and potential litigations, if such transmission processed by them turns out to be a fraudulent claim. The delay with IEPF could, however, be linked with the emphasis on warding off and protecting the assets from fraudulent claims, that even genuine claims have to go through the tough grind.

If the government could look at ways to address this pain-point, it could do a world of good to persons like Akash.

To-dos for readers

- Proactively check with your parents if they had invested in equities during anytime in the past, like the stock market boom in the 1990s. Easier to dematerialise the shares in their lifetime.

- Alternatively, check for information in the IEPF search portal (

- If they had invested, check for their names in the list of shares transferred to IEPF as provided by the respective companies.

- Follow it up with the company and RTA, if the shares are not transferred to IEPF.

- Though the pace of communication might be slower from the company or the RTA, it is important to follow up relentlessly and escalate wherever necessary. Persistence matters here.

- If you find the process time-consuming, check for services offered by recovery consultants like Share Samadhan. While not all the time, sometimes you have to balance out the time and effort that you need to expend if you do it on your own, vs the fee shared by the consultant. But be sure to check the authenticity and genuineness of such consultants before you proceed.

- Appoint a nominee to your investments now to save trouble for your successors.

If you are amongst those that are facing problems like Akash, and would like to share your experience, please write to us at blportfolio@thehindu.co.in.