‘No he won’t.’

‘He is just playing it up to bring other countries to the negotiating table.’

‘Tariffs will be bad for the US economy.’

After these and many other opinions floating around for nearly two months, it is now clear many experts may have got it wrong when it comes to US President Donald Trump and tariffs. He is more serious than what they initially imagined and it’s quite evident now that reshoring manufacturing back into the US is one of his top agendas in the current term. This appears to be part of a grandeur vision to strengthen the US strategically in a new world order and the Trump administration is ready to risk the economy slowing down or even entering a recession, if need be, so to ensure a ‘transition’ in the economy.

With reciprocal tariffs likely to start on April 2, how will it affect few sectors and stocks in India? While there are many moving parts and ambiguity, here’s some perspective to get you prepared. This is based on discussions on tariffs doing the rounds now and may change.

Auto: Gear up for a bumpy ride

Tariffs imposed a day and exempted another, just like the back and forth between President Trump’s red and blue ties have left the auto industry puzzled. The way Trump is wielding the ‘T’ word has brought the ‘U’ word along with it. U for uncertainty. Uncertainty as to whether the 25 per cent auto tariffs will be imposed on auto components too, as they apply for built vehicles? With reciprocal tariffs kicking in from April 2, will auto components be exempted, given the dependence of US OEMs on imports? Will Government of India yield to Trump’s demand for lower tariffs, paving way for the entry of Teslas and the like?

Our best assessment is that Indian frontline OEMs will be unaffected, while the auto ancillary players may experience a second-order impact, due to tariff-caused slowdown in the US auto market. Let us break it down for you.

The macros

A quick look at the aggregates first. Per Ministry of Commerce, India’s exports to the US in FY24 were $77.5 billion, of which auto exports (including parts) are just 3.4 per cent or $2.65 billion. Parts account for $2.14 billion; tractors account for $0.27 billion; passenger vehicles, two-wheelers, commercial vehicles put together account for the rest – $0.24 billion. This is just a tiny drop in the ocean compared to the size of India’s auto parts market at over $60 billion (FY24 revenue of 197 listed auto ancillary companies, for lack of a better estimate — source: Capitaline). India’s passenger vehicle market alone is worth about $42 billion (FY24 estimate, per Hyundai’s RHP), let alone commercial vehicles, two-wheelers and three-wheelers. Hence, it is safe to say that the impact at the industry level could be immaterial, as India has a robust domestic market.

Before diving into the company-level analysis, we would like to start with a disclaimer. To meaningfully analyse the impact of tariffs, the information on movement of goods into the US, from jurisdictions subject to tariffs and their monetary value, is required to reliably make an estimate of the impact on a company’s revenue. However, such information is not readily available in the publicly-reported documents of most companies. Further, the presence of group companies/ plants in the US, Canada and Mexico make things more complicated. Hence, relevant proxy information is given wherever possible. Numbers referred to here pertain to FY24.

With that out of the way, let’s tackle the question – will the listed OEMs be affected by tariffs imposed on exports to the US? The two-wheeler OEMs first.

Impact on two-wheelers

The US is home to a breed of large capacity motorcycles (twin cylinders, three cylinders and the like), which is not exactly the bread and butter of the likes of TVS, Bajaj and Hero. Also, these companies export only to markets in Africa, Latin America and South-East Asia. However, Royal Enfield that makes relatively-larger bikes, has a US subsidiary importing CBUs (completely built units) for sale in the US. But the exact contribution to revenue from this unit is not reported. The share of Royal Enfield’s international business in Eicher Motors’ revenue is about 11 per cent. The company has presence in other overseas markets such as Canada, Latin America, Europe and South-East Asia. Overall, the two-wheeler OEMs will remain unaffected by tariffs.

Passenger vehicles

Coming to passenger vehicle OEMs, Maruti, Mahindra and Hyundai largely export to Latin America, Africa, West Asia and South-East Asia, and do not have a meaningful exposure to the US. Tata Motors, on the other hand, has exposure to the US through JLR (Jaguar Land Rover). This revenue may or may not be susceptible to tariffs. JLR plants are located in the UK, Europe and China. Tariffs may not impact, as JLR cars sold in the US are mainly from the UK and Europe. However, when reciprocal tariffs kick in, even imports from Europe into the US will be affected. About 15.4 per cent of Tata Motors’ revenue is from the US.

CVs, Tractors

None of the commercial vehicle majors – Tata Motors, Mahindra and Ashok Leyland seemingly export trucks to the US. As mentioned earlier, tractors constitute a sizeable portion of India’s auto exports to the US. For Mahindra’s tractors, the US is the second-largest market after India. In FY24, the company had launched the ‘OJA’ range of tractors there. Nevertheless, tractor exports contribute to less than 1 per cent of the company’s revenue. Tractor exports contribute to about 4 per cent of Escorts Kubota’s revenue, but it is not known if the company exports to the US.

Auto ancillaries

Unlike OEMs, Indian auto component players have a sizeable exposure to US markets, making them a possible casualty to reciprocal tariffs. While the US charges a mere 2.5 per cent on auto part imports, India charges 15 per cent. If reciprocal tariffs take effect, US OEMs such as Ford, General Motors and Stellantis (also known as the Big 3), importing auto parts from India, will have to shell out 6x the erstwhile import duty (15/2.5). This is important because these companies are not financially well-off to afford any hit to their margins. The EBIT margins of the Big 3 in 2024 were 2.8 per cent, 6.8 per cent and 2.4 per cent respectively. This partly explains their choice of cheaper imports from India.

Further, such OEMs have supply chains that are deeply rooted in Canada and Mexico (again, for cost reasons), explaining why a one-month exemption was given in early March to continue imports from Canada and Mexico, lest operations will stall. Their capacities within US borders are already on full throttle that only fresh capacities or relocating existing Canadian and Mexican plants to the US can save them from tariffs. Both of which need massive capital and time. Their managements have acknowledged that they’ll have no choice than to pass on additional costs to car buyers.

This will come at a time when there are already concerns that no new car is affordable, with average price reaching $45,000, as per some reports. The managements of most Indian auto part companies have opined that in the event of reciprocal tariffs, they are not willing to bear any of the impact, further guaranteeing a case of pricier vehicles for the American consumer. When this trickles down to a slowdown in US’ auto market, Indian auto part companies with significant exposure to the US will experience second-order impact of slower revenue growth.

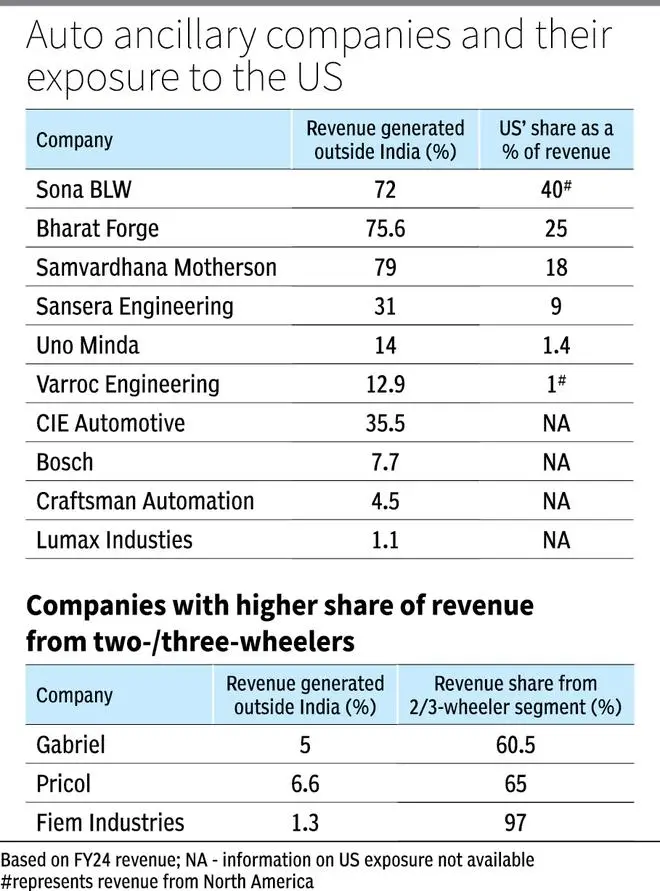

As the universe of India listed auto part companies is large, we have analysed a few of the more prominent ones here and their exposure to the US is given in the infographic. This apart, for Sundram Fasteners, General Motors is one of the top five customers and these customers account for 35 per cent of the company’s revenue. Companies with lower exposure to exports or a higher share of the two/three-wheeler segment could relatively fare better.

In the event India lowers duties…

So far, we’ve dealt with tariffs on India’s exports to the US. Now let’s deal with the possible scenario where US OEMs enter India on the back of lowered tariffs by our government.

In the Budget of 2025, the government had slashed customs duties on imported cars worth more than $40,000 and large-capacity motorcycles, among others. Trump has been quite vocal recently that India has agreed to lower tariffs. Tesla has already leased showrooms in Mumbai and Delhi. All these indicate that the government could lower duties further. The government already has in place a new EV import policy, brought in recently, which allows foreign OEMs to import limited units at 15 per cent duty, conditional upon setting up manufacturing in India. Given that the likes of Tesla already have surplus capacity and might not commit to capacities in India, the conditions in this policy could be made less stringent.

In that case, it will have to be a CBU import of the entry-level Model 3, which costs about $35,000 (₹30 lakh) in the US. Add to this, shipping, GST, cess, insurance and local taxes, Tesla patrons could be staring at a bill, well north of ₹40 lakh. That’s steep and unattractive, especially considering Tesla has to build the charging network and service stations from scratch. At this price point, listed OEMs – Tata Motors, Mahindra, Maruti and Hyundai are well guarded, as their offerings start low between ₹10 lakh and ₹20 lakh. Other American OEMs, the likes of Ford and GM, having retreated from the Indian market in the past, are unlikely to re-enter the affordable segment of the market. Similarly, listed two-wheeler OEMs will also be largely immune to the threat to their premium bikes, since the starting price of popular American motorcycles such as Harley Davidson and Indian motorcycles start above $10,000 in the US.

Any localisation attempts by such new entrants are positive for the auto ancillary players.

Pharma: A bitter-sweet pill

At first glance, India’s pharmaceutical trade with the US favours India. Not only does India enjoy a high trade deficit, that trade is taxed unevenly as well. Reciprocal tariffs or a flat 25 per cent tariff will have an impact on formulation makers, but might spare the API segment. However, a case can be made for easy resolution.

Trade equation

India exported pharmaceuticals worth $12 billion to the US in 2024 and imported $0.6 billion from the North American country as of 2023, according to the UN trade database. While the US charges a minimal or zero tax on the $12 billion, India imposes a 10 per cent tariff and other local taxes (GST and others) on the imports. The impending tariffs on Indian exports to the US, to be announced on April 2, could be a 25 per cent tariff – an assumed worst-case scenario – or a 10 per cent tariff in case of reciprocity. The exports are primarily generics, as close to half of the generics consumed in the US are sourced from India.

The impact of tariffs will be product-dependent; specifically, the competition from the US-based manufacturers in that formulation.

For instance, consider Ibuprofen 200 mg tablet. There are several Indian (Granules, Aurobindo, Dr Reddy’s), Chinese (Shandong Xinuha, Zhejiang) and even European (Sandoz) companies, which will face a 25 per cent tariff evenly. The advantage will be with the US companies (Perrigo, Amneal or Teva and Actavis) depending on the capacity to ramp up Ibuprofen and several other generics from the existing US capacity. India and other generic operators will have to match the non-tariff price coming from the US competition by slashing their margins. The US being a consolidated buyers’ market, price competition will be drawn to the maximum.

Impact on companies

The base-case scenario is that the impact will be slow to disrupt, based on competing bids in specific molecules backed with the US capacities.

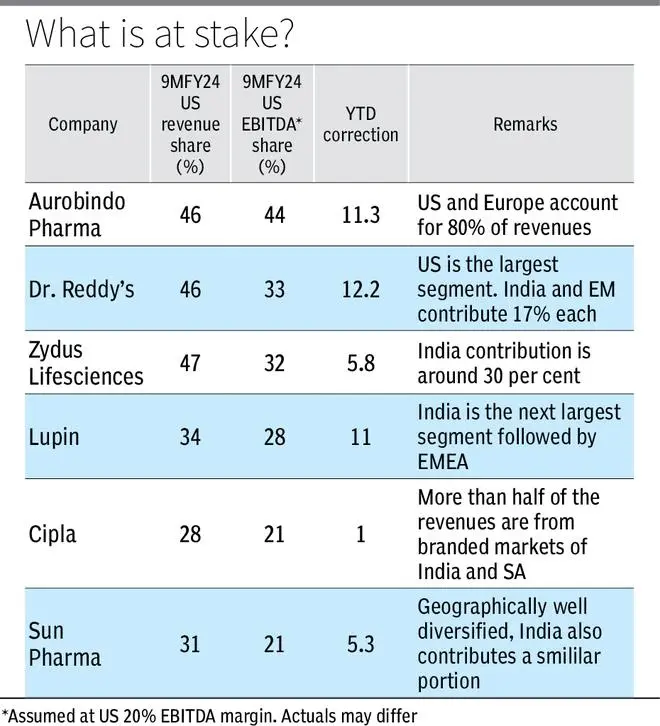

The most impact is likely to be on Aurobindo Pharma and Dr Reddy’s. The companies derive close to half of their revenues from the US (see table) and that too from uncomplicated products, which are most likely to be challenged by the US-based competitors.

Zydus Lifesciences, Lupin and Cipla are higher up on portfolio complexity, which face limited-to-low competition. The long-term implication, though, would depend on ramping up of the US capacities in specific molecules.

Sun Pharma has gradually morphed into a speciality player. The tariff impact should be largely borne by the purchasers as the high-value products — such as Ilumya and Cequa — are brands built on data from clinical trials and not price competition.

Scope of resolution

First, the US generics market has witnessed high generic drug shortages even before tariffs were in the picture. A nearly decade-long effort to increase competition and consolidate buyers has led to many product exits, thereby resulting in shortages. The tariff imposition on generics will further increase the gap and the prices. A price war in generics is also less efficient, as 80 per cent of the US pharmaceutical consumption, by value, is concentrated in 20 per cent of innovator companies. Of this, Ireland (by virtue of low corporate tax) and Switzerland (European pharma hub) account for a major portion and also have a high trade deficit with the US.

Second, Indian imports from the US include cancer and other high-value therapies, which deserve lower taxation, on humane reasons. A market formation triggered by lower domestic tariff will also lead to patent challenges in India, which can benefit India.

Third, the tariff impact crystallises into lost market share only upon US capacities for generics ramping up. In the absence of capital formation to pursue the endeavour based on a fickle tariff war, the cost of tariff will be shifted to US payors and not borne by the manufacturers.

In essence, formulation players will have to brace for a period of lower margins in simple products that might face higher US capacities. This will be a long-drawn affair with scope for readjusting portfolios to counter the measure.

Low impact on APIs

API exports will also face reciprocal tariffs, but the impact should be lower, if any, owing to low-cost and relationship-based supplies. A typical API would account for not more than 5 per cent of the cost of a formulation, ranging around 2 per cent. This implies that on imposition of a 25 per cent tariff, the formulation cost would increase by a mere 0.5-1.25 per cent. A formulation manufacturer may be willing to absorb the cost. Not only is the impact lower, the cost of shopping for another cheaper API might be costly as well. APIs that go into a formulation must be documented and changes need prior approval from the regulator.

Also, China dominates API exports to the US, which will also be at the receiving end of the tariff imposition. Companies such as Granules, Neuland Labs and Shilpa Medicare might not face pricing pressure on account of tariffs.

Steel: Safeguarded for now

The US has already imposed a 25 per cent tariff on all steel imports on March 12. Following this, President Trump has threatened further tariffs in response to a rather swift retaliation by Europe and Canada. The only certainty is that the tariff volatility is just beginning and can swing in any direction.

The impact of the steel tariffs — US imports amounted to $34 billion in 2024, according to the UN trade database — will be felt by Canada, which accounts for 23 per cent of US imports, Brazil (15 per cent), Mexico (10 per cent), Korea (6 per cent) and Germany and Japan (4 per cent each). China, which has the largest steel capacity in the world, accounted for only around $500 million or 1.5 per cent of US imports.

Indian steel exports were under $500 million, which is less than 1 per cent of the country’s output. It can be safely assumed that the impact on Indian steel from tariffs will be very minimal or manageable.

Company-wise, steel exports constitute 10-15 per cent of revenues for Jindal Steel and JSW Steel, and less than 10 per cent for Tata Steel and SAIL. Of that, Europe accounts for around half of the exports, while China, Nepal, West Asia and other neighboring countries account for the rest.

Floating steel

While direct impact should be negligible, the indirect impact of tariff barriers could be negative for Indian steel. India is the second-largest producer (140 mtpa – million tonnes per annum) and consumer (130 mtpa) of steel.

This is dwarfed by China, which has a capacity of 1,050 mtpa and consumes 900 mtpa of steel leaving 100 mtpa of steel for exports every year. This is followed by Russia (32 mtpa excess capacity), Japan (23 mtpa) and South Korea (12 mtpa), according to Worldsteel.org. All these countries, in India’s vicinity, have excess capacity and will be hit hard by tariff imposition. The floating capacity will find its way to domestic shores, if left unprotected.

Import duty

It is precisely in this context that India’s Directorate General of Trade Remedies (DGTR) has recommended a provisional safeguard duty of 12 per cent on steel imports, announced on March 18.

India imported iron and steel worth $ 18.9 billion in 2023, which is a 13 per cent year-on-year increase. Korea and China accounted for $2.6 billion each and imports from China has increased 37 per cent year on year, while that from Korea declined 8 per cent in 2023. The higher imports from China, which are also at a lower price, have led to steel price decline domestically. The average realisation across the three large steel producers (JSW Steel, Tata Steel and Jindal Steel) has declined 15 per cent year on year, on an average, in 9MFY25. Steel realisation has steadily declined from highs and are currently at a significantly lower level.

In the context of steel, Indian import duties that have been announced will be central to safeguarding domestic industry rather than the US-India trade tariff war. This has been a long-pending demand from the industry, has only been announced recently. This considers the severity of the trade flows already noticed, according to the report by the DGTR, since March 12, when the US announced the 25 per cent tariff on steel imports.

The import duty of 12 per cent should alleviate the declining realisation of steel companies, which are also in the midst of a capacity expansion.

- Also read: Agri stocks and tariffs: Not much to fear right away