Liquidity, or what we can call flow of funds, increases as economic activity picks up. At times, the central banks exercise their enormous powers to infuse more liquidity into the system than is warranted by normal increase in activity. It is deployed as an accelerator. After 2008, central banks have used this tool aggressively, consistently and pre-emptively. A good part of this liquidity has found its way into financial markets, particularly equities. This asset class has been responsive in re-rating fast. In China, the liquidity went into properties. Wherever the liquidity surge happened, the impact has been a distortion in asset prices.

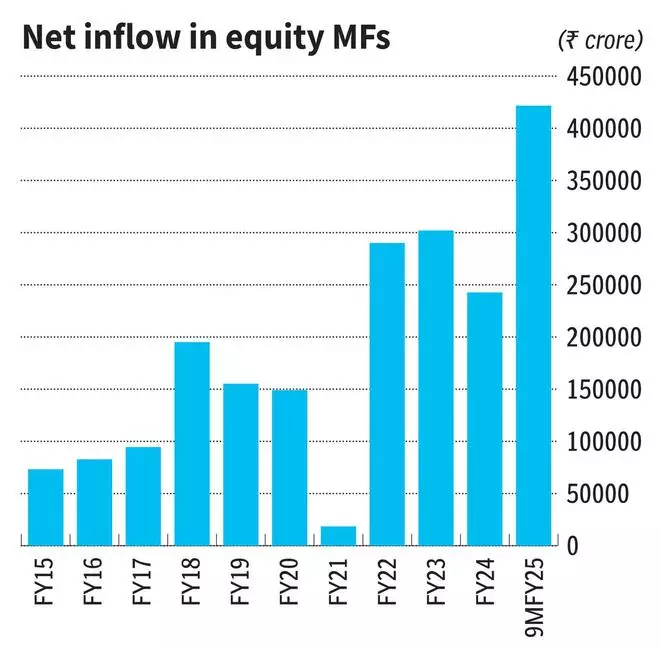

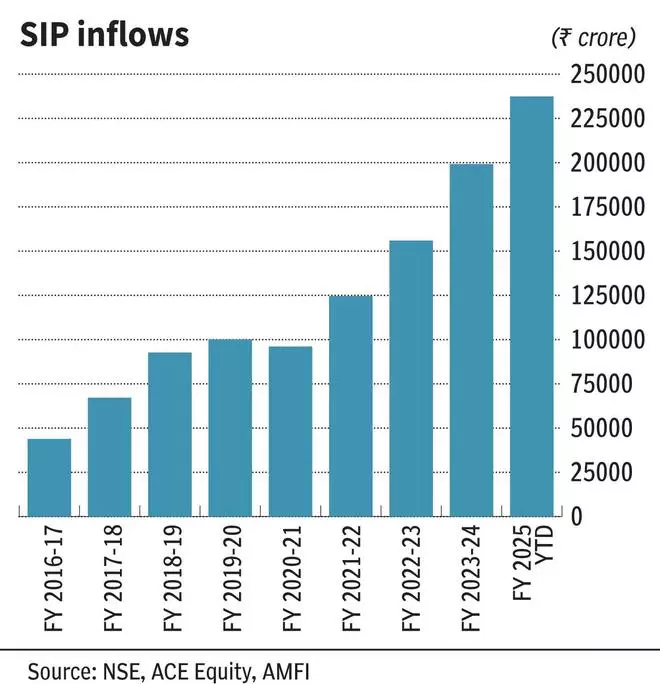

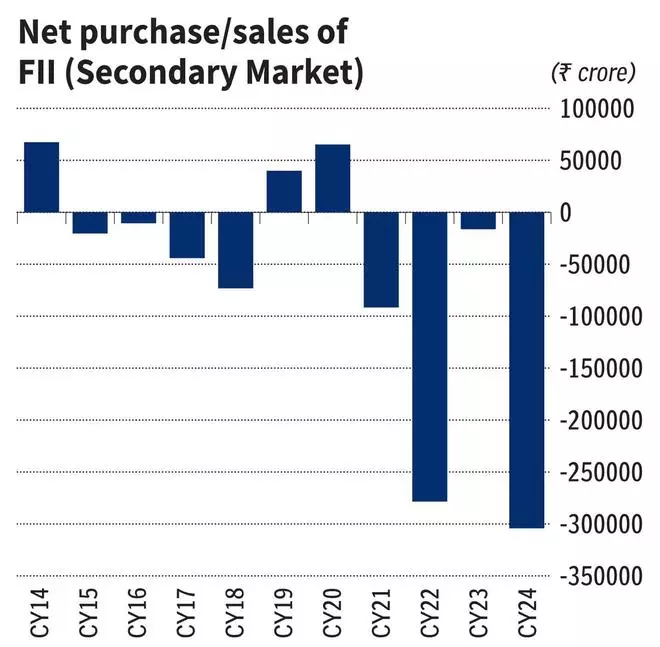

For India, the liquidity surge into stocks came from foreign portfolio investors (FPIs) who found Indian growth to be attractive, from the so-called carry trade (cheap USD being used as an arbitraging mechanism across markets), and from domestic investors who stepped up their exposure to equities — either directly into the market or through SIPs.

The notion of positive liquidity towards the market comes from the fact that this flow of money has generally been on an ascent. This inflow has tended to dwarf the quantum of selling and supply of new equity issuances. Consequently, the bull market has seen accelerating returns with the five-year CAGR of Nifty standing at 14.6 per cent as against the 10-year CAGR of 9.6 per cent.

Markets cannot be a function of just demand and supply in isolation. The balance is tilted by expectations of the same, in turn driven by fundamentals. Somewhere in the euphoric journey, stock investors benefited by the momentum in flows with strong and improving fundamentals. As equity valuations became bloated, the gap between intrinsic value and price has widened.

The risks have been building up silently. In the post-Covid era, a few developments aided liquidity. One, the Indian economy has been a good performer after the digital divide re-shaped the landscape though the recovery was K-shaped. Earnings growth picked up. Secondly, the SIP crowd has been on the rampage and the improving return trajectory has brought in more funds as well as fresh narratives into the market.

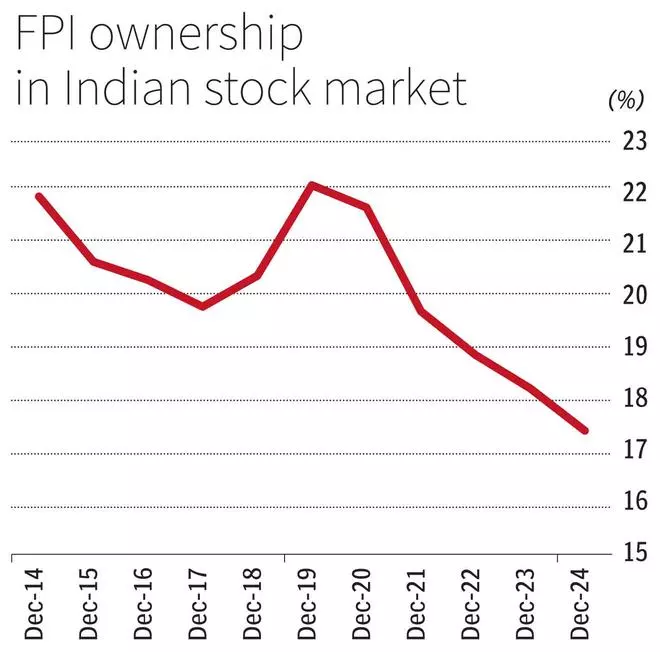

Meanwhile, the FPI ownership has been going down in recent years.

FPIs have the benefit of institutional memory of lessons learnt on liquidity in Japan, South-East Asia, China and elsewhere over many decades. They turned sellers when there were willing buyers at all levels. We raced to 26,218 on the Nifty against a backdrop of persistent, but well-thought-out, selling by FPIs and committed, but ill-advised, buying by many others including the SIP-led funds and HNIs. This came amidst a slowing economy in FY25 with pedestrian earnings growth. The stage was getting set for a perfect storm.

The collapse & beyond

The market was waiting for a trigger, which came through the US markets. Initially, the US bond yield went past 4.5 per cent to a fresh 25-year high even as the US Fed started to ease rates. The market signalled a divergence and revealed a mind of its own. Subsequently, we have seen some aggressive posturing on tariffs from the new US administration, which is increasing uncertainty and risks. This does not bode well for Indian stocks. The pullback has been devastating for the small-/mid-caps where the excesses were palpable and unchecked.

Going forward, there are no easy exits from this spiral of negative liquidity (FPIs being net sellers). The liquidity is negative on balance as the pressure of more and potential supply has brought the demand sources to their knees.

Earnings growth cannot materialise soon enough to solve this problem. Given the stronger USD and the trade tensions, there is a fair probability that the growth recovery will be pushed back to at least the second half of FY26. Even when growth returns, companies with scale will take the podium. Small-/mid-caps in general will not come back so easily. This prospect is unpleasant, but unfortunately real.

The prospects for positive liquidity from FPIs hinges on how soon we can get a price re-set that can offer a margin of safety to potential pools of long-term capital. Regrettably, the obsession with talking up the domestic flow of savings into equities in an expensive market and combining this with a disciplined approach to investing has ended up giving an easy exit to FPIs. This continues.

While the cliché always says that India is a stock-picker’s market, we are in a macro-driven market for now. Positive liquidity can materialise on a consistent basis only when there is confidence that growth can return coupled with reasonable valuations. In many small-/mid-caps, the math refuses to add up despite the carnage. When liquidity drove up markets, the deteriorating fundamentals were ignored. When liquidity turns the other way, improvements are likely to be pushed back, thereby making the pendulum swing to the other extreme. Fasten your seat belts and let the storm pass.

The author is Managing Director and CIO, Spark Asia Impact Managers