In the market correction over the past 5-6 months, there has been a significant disparity in how frontline indices have fallen and the way valuations have panned out.

While the large-cap indices have declined about 15 per cent over this period, the mid and small-cap benchmarks have fallen by 25 per cent or more.

However, this correction has resulted in the Nifty 50 and Nifty 100 seeing their PE multiples go below 20 times, while the mid and small-cap indices still trade well above 25 times.

So, large-caps have relative valuation comfort and may be the first to recover when the market regains its momentum.

In this regard, HDFC Large Cap (HDFC Top 100 earlier) is a fund that investors can consider from a long-term perspective of at least 7-10 years.

The fund has a very long track record of operations since 1996 and has delivered healthy benchmark beating returns over the long term.

Taking the SIP route for exposure to the fund would help average costs and reduce portfolio volatility.

Steady outperformer

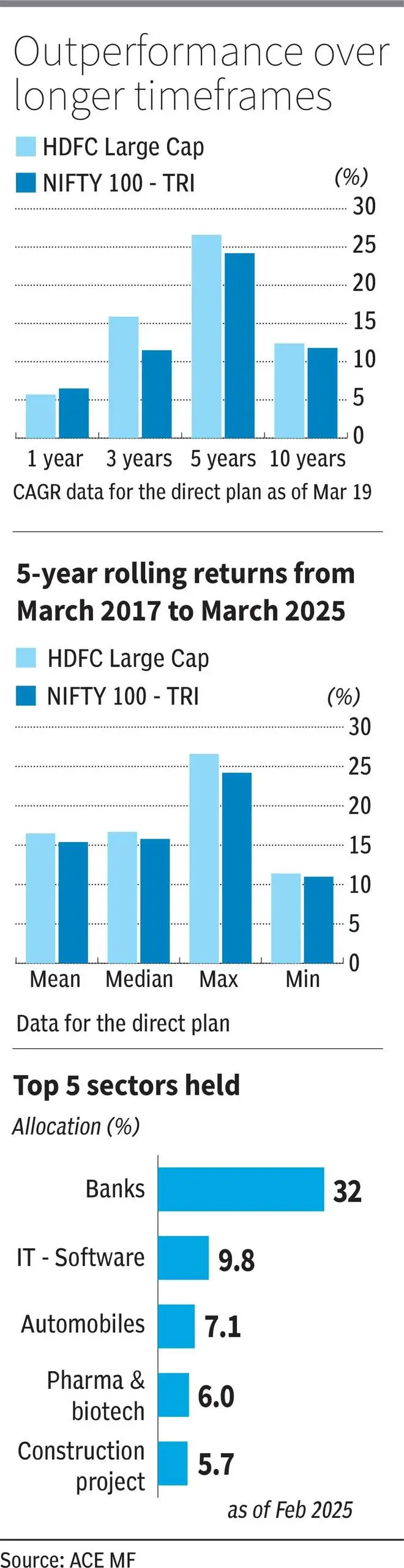

HDFC Large Cap has outperformed the Nifty 100 TRI over the past decade or so, when medium to longer timeframes are considered.

In the past 3-year, 5-year and 10-year timeframes, the fund has delivered 15.9 per cent, 26.6 per cent and 12.4 per cent, respectively, on a point-to-point basis.

When five-year rolling returns over the period March 2018 to March 2025 are considered, the fund has delivered mean returns of 16.5 per cent. For comparison, the Nifty 100 TRI delivered average returns of 15.4 per cent.

Also, in the aforementioned period, on a 5-year rolling basis, the scheme has beaten its benchmark Nifty 100 TRI over 97 per cent of the time. It has delivered more than 12 per cent over 95 per cent of the time during this period and more than 15 per cent for nearly 69 per cent of the time.

The fund’s SIP returns (XIRR) over the past 10 years are healthy, at 14.7 per cent. An SIP in its benchmark Nifty 100 TRI would have returned 13.6 per cent over the same period.

All return figures pertain to the direct plan of the fund.

HDFC Large Cap fund has an upside capture ratio of 102.2, indicating that its NAV rises a bit more than the benchmark during rallies. The scheme has a downside capture ratio of 76.3, suggesting that the scheme’s NAV falls much less than the Nifty 100 TRI during corrections. A score of 100 indicates that a fund performs in line with its benchmark. These observations are based on data from March 2022 to March 2025.

Smart sector mix

HDFC Large Cap stays true to its investment mandate across timeframes. Therefore, large-caps account for 93-95 per cent of its portfolio. It avoids mid and small-cap exposure, unlike a few other schemes in the large-cap category that do to generate extra returns resulting in higher risks.

The exposure in large-cap stocks is reserved for the top few companies in any given sector. The portfolio has a value and GARP (growth at reasonable price) mix of styles. Almost all of the picks are from the Nifty 100 index.

Banks and IT software are the top couple of segments held by the fund across all timelines. In the current environment, especially after the recent fall in these sectors, there is likely to be more value available.

Other sectors in the fund are churned in response to market dynamics and segment potential. Currently automobiles and pharmaceuticals are key sectors in the portfolio.

Earlier petroleum products and finance companies figured prominently. Keeping exposures to the relatively lackadaisical FMCG sector at modest levels has ensured that the fund did not suffer underperformance.

The fund generally holds around 40-50 stocks in its portfolio. The portfolio is concentrated at the apex with the top 10 stocks accounting for over 58 per cent of the portfolio. But beyond that, the holdings get quite diffused across stocks.

Barring banks, sector holdings are usually in single digits, making the portfolio quite diversified.

HDFC Large Cap remains invested to the tune of 95-98 per cent, and rarely holds high cash and debt positions beyond 2-5 per cent.

The fund is suitable for investors with a medium risk appetite as a portfolio diversifier. Investors saving for financial targets that are 7-10 years away can opt for the systematic investment route.