The rupee is the chink in the armour for the Reserve Bank of India today. With the inflation situation right now under control, the central bank could have given itself a bit more room on the policy rate decision.

However, the sustained depreciation and volatility in rupee in the last three months makes the situation vulnerable. As RBI gears up for the MPC meet, the question is, can the central bank go ahead with a rate cut given the rupee scenario? Will the heightened rupee volatility weigh down on the first MPC decision of the financial year 2025-26?

The rupee moved from 84.55 on December 2, 2024, to a high of 87.99 on February 10, 2025, with massive intra-day trading range of around 90 paise. With RBI interventions, as reported by the press, the rupee fall was arrested: rupee appreciated to 85.40 by March 28, 2025, while being volatile.

Compared to the movement in 2023 and 2024, the movement in 2025 is both bigger and sharper. The entire third quarter of 2024-25 (August-November), rupee in contrast, just moved in a range of around 40 paise – 83.70 to 84.10. While ideally MPC decisions should be independent of the rupee vagaries, a sustained deprecation can aggravate inflationary tendencies at home and hence keeping an eye on the rupee is necessary.

In fact, in the interconnected and politically volatile global environment, with dollar as the dominant reserve currency of the world, it would be too much to expect monetary policy decisions to be independent of rupee volatility.

Moreover, since stemming rupee volatility is a stated policy goal and interest rate decisions also impact the short-term FII flows through interest rate differential, the close connect between monetary policy decisions and rupee movement cannot be ignored.

Inflation impact

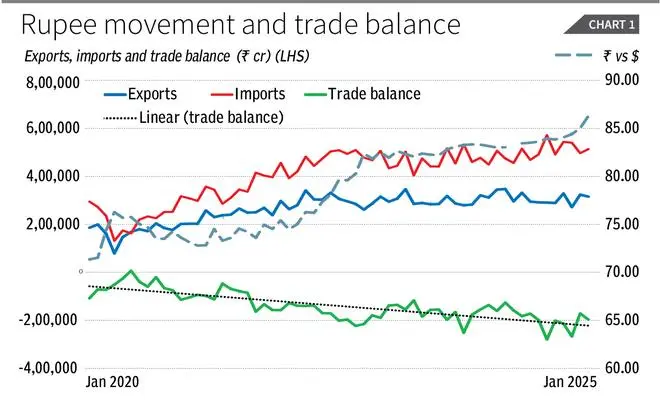

First, depreciation means we will be importing inflation, which undermines RBI’s ability to achieve the inflation targets. The inflation-depreciation liaison can wreck domestic economic gains. Chart 1 shows that the trade balance has been deteriorating in the last few years.

Imports have slightly dipped and exports have increased in recent months, but the general trend shows a greater rise in imports than exports. Moreover, we can see that the sharp depreciation of rupee in 2021-22 and more recently, has coincided with a steep upward move in import bill. Worryingly though, even with the rupee depreciation, exports have seen only a modest upward movement. Additionally imported inflation, particularly through WPI movement, can have negative impact on real GDP growth through changes in GDP deflator.

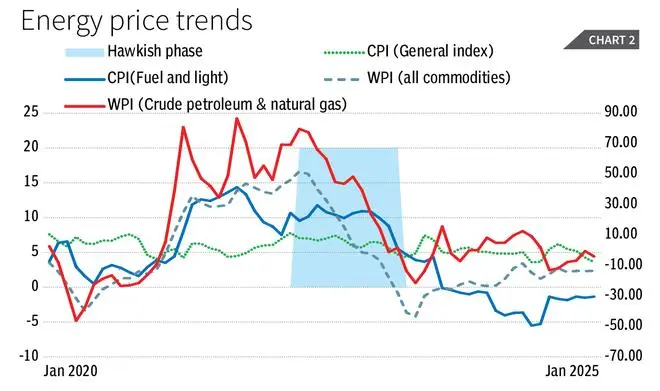

India has a major exposure to crude oil prices. While the crude prices have moved down in recent times, we cannot rule out a volatile crude movement given the global geopolitical scenario, which is likely to further put pressure on the trade deficit. The key variable here would be rupee value, and a sharp depreciation will hurt both domestic manufacturing and exports, given their dependence on imports. The consumption demand will also be hit if fuel and energy prices move upwards (Chart 2). The domestic ramifications of a rupee deprecation suggest the rupee cannot be left to fall freely.

Second, the escalating tariff situation, with an economy the size of US imposing tariffs, has long-drawn impact on consumption, incomes, and resource allocation of trading partners. The use of tariffs today, after 25 years of existence of the WTO is by itself an erosion of the gains made in global trade.

With tariffs being imposed on major economies, trade partnerships and likely tariff structure of these countries will change, leading to global shocks in export demand. This will further greatly impact rupee depreciation.

India has so far not clearly spelt its stance on the tariff issue, adding to the policy uncertainty.

Not wanting to ruffle too many feathers may not work in the high-stakes global environment today, especially when even trade deals effected earlier are being questioned. Overall, the general equilibrium effect of increased tariffs cannot be simply ignored.

Third, intervention in forex market by RBI and liquidity in the domestic market is intrinsically connected; that can make the policy rate decisions dependent on exchange rate changes.

Reserves impacted

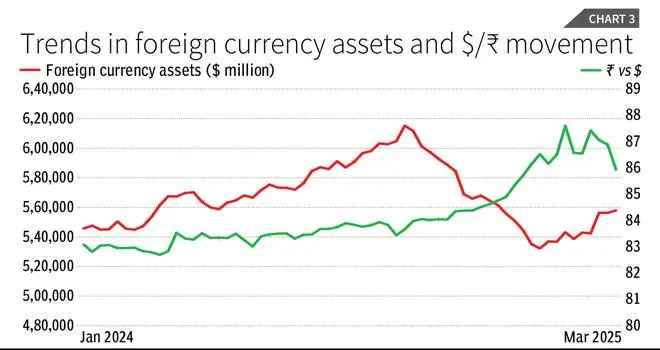

From October 2024 to February 2025, the interventions to support rupee led to a sharp fall in forex reserves (Chart 3). Spot interventions to support rupee by selling dollars led to fall in domestic liquidity and to avoid domestic repercussions forward market interventions were carried out by the central bank.

While forward market interventions effectively push obligations to the future, if the global conditions are unfavourable when swaps mature, the pressure on forex reserves will be substantial. While the increase in reserves in the last two months has been positive, it is also a fall-out of the forex buy-sell swaps being conducted by RBI to infuse rupee liquidity, and hence should be seen with caution.

Fourth, in the March 18-19 meeting, Federal Reserve decided to keep policy rate unchanged with indications of slower growth and higher core inflation by year-end. If RBI cuts the policy rate, FII outflows may intensify rupee depreciation.

In this scenario, we must closely question the benefits of rate cut: will another rate cut now help in boosting GDP growth? Are we depending too much on short-term liquidity injections for growth revival rather than a focus on the long-term issues of capital accumulation, technology adoption and skill formation in the manufacturing sector? Can credit growth alone boost growth? Will the rupee movement compromise on the inflation targeting framework?

Smita is Associate Professor, National Institute of Bank Management; Das is ICICI Chair Professor, Indian Institute of Management Ahmedabad. Views expressed are personal