The United States remains the top destination for India’s agricultural exports, and India is an important destination for US exports. Will ‘reciprocal tariff’ pose a threat to India, or can India turn this challenge into an opportunity? We delve into uncovering bilateral agri-trade dynamics between the two nations.

First, historically, the tariff disparity of 32 percentage points prevailed in agriculture trade between the two nations. India imposes a weighted 37.7 per cent tariff compared to the US’s 2.6 per cent.

In view of this long-standing tariff gap, ‘reciprocal tariff’ imposition raises concerns about the fate of India’s major agri-products, namely rice (basmati and non-basmati), marine products (shrimp), wheat, and buffalo meat constituting 46 per cent of India’s agricultural exports to the US. On the other hand, India’s imports from the US will be impacted as about 82 per cent of the total comprises pulses, vegetable oils, cocoa, raw jute, and fresh fruits.

The total agricultural trade between the US and India was reported at $6.6 billion. India exported $5 billion to the US, and the US exported $1.5 billion to India, out of the $129.2 billion total goods traded in 2024. Though India is the tenth exporter of agricultural products to the US, Mexico, China, and Vietnam are ahead of India.

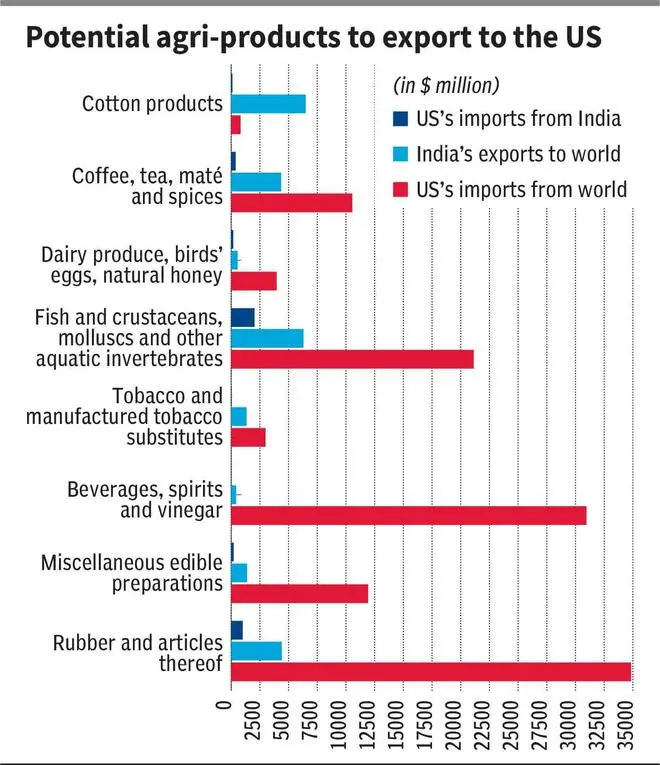

However, India’s agri can further unlock export potential in the US market. Rubber and its derivatives, beverages, spirits, vinegar, tobacco, fish, dairy produce, and cotton can increase India’s agri-trade export volume with the US.

IPEF initiative

India must account for the impact of recent trade agreements between the US and other countries. For instance, in May 2022, the Indo-Pacific Economic Framework for Prosperity (IPEF) initiative was signed between the US and Australia, Brunei, India, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Thailand, and Vietnam to strengthen food safety and standards and reduce agri-trade barriers for the US. India’s share in the global agricultural export increased from 3.4 per cent in 2010 to 7.8 per cent in 2022 and net agri-export value grew at a 7 per cent CAGR from 2017-18 to 2022-23. The impact of IPEF on India’s bilateral trade in agri with the US remains a grey area.

India might face tough competition in agri-trade as the US will likely strengthen the US-Mexico-Canada Agreement by 2026. However, tariffs on Mexican and Canadian agri products by the US can be a ‘blessing in disguise’ for India.

A few impediments may slow down India’s agri-export momentum to developed countries, including the US. Technology-enabled modern logistics, stringent quality assurance mechanisms, and (cold) storage and cool chain facilities remain pain points.

World Bank’s Logistic Performance Index report reveals that though India improved its position from 54th in 2014 to 38th in 2023, logistical performance is far behind Canada, China, South Africa, and Malaysia.

These influence the US’s expectations as an importer, especially for perishable agri and livestock products. FAO estimated India’s food waste stood at about 40 per cent, and about 30 per cent of fruits and vegetables perished due to poor storage facilities.

Sanitary and phytosanitary standards and greenhouse gas emissions-embodied agri-trade can affect international trading partners entering a bilateral trade with India or committing them to long-term regional trade agreements. So, India must comply with developed nations’ trade and environmental regulations.

India faces structural challenges, namely small and fragmented landholdings, lack of aggregation and value addition, and aggregate measures of support restraining small producers and micro-enterprises from achieving economies of scale and scope.

Addressing these challenges can strengthen India’s position in bilateral trade and create a resilient agri-export system amid the topsy-turvy trade policies of developed nations.

Banerjee is an Academic Associate at IIM Ahmedabad. Dey is an Associate Professor at IIM Lucknow. Views expressed are personal